April 11, 2022

What goes to Jupiter goes to the bull!

Russian Foreign Minister Sergey Lavrov once again announced that in Ukraine, the Russian army is fighting for the recognition of Russia as a great power that can do anything and will get nothing for it. Like the United States.

“Our special military operation is designed to put an end to the reckless expansion and reckless course of total domination of the United States and under it the rest of the Western countries in the international arena.

In Kosovo, you can recognize independence without a referendum. Still, in Crimea, as a result of a referendum watched by hundreds of objective representatives of foreign countries, the public of foreign countries, you cannot. In Iraq, 10,000 miles away from the U.S., they saw a threat to their American security, bombed it, found no danger, and didn’t even apologize. And when we have neo-Nazis and ultra-radicals breeding right on our borders, creating dozens of biological laboratories under the Pentagon, conducting some experiments that are primarily aimed at creating biological weapons—documents have been found that leave no doubt about this—then we are not allowed to respond to this threat on our borders, not across the ocean.

This statement indicates that the Kremlin sees an end to the war in Ukraine only due to direct negotiations between Moscow and Washington. Potsdam 2.0.

New sanctions

As part of the fifth package of sanctions against Russia, the European Union closes its ports for ships flying the flag of Russia after April 16. Still, it is unlikely to be a severe blow to the logistics of Russian foreign trade. First, the restrictions do not apply to ships transporting agricultural and food products, energy carriers, and pharmaceutical and humanitarian cargoes. Second, the share of shipments transported by vessels under the Russian flag in the cargo turnover of Russian seaports is about 2%, and the percentage of cargoes transported by Russian ship owners is about 10%-15%. Thus, in 2021 the share of oil and oil products transported by ships flying the Russian flag was 7% of the total sea export shipment in that segment; coal and coke was 11.9%; grain, 23.7%; liquefied gas, 0.27%; ferrous and nonferrous metals, 19.51%; containerized cargo, 0.7%.

The European Union imposed sanctions on supplies of oil refining and liquefied natural gas (LNG) equipment to Russia. The ban applies to exports, directly or indirectly, of goods and technologies used in oil refining and natural gas liquefaction, regardless of country of origin, to any person or company in Russia, or for use in Russia. Russia has two LNG plants under active construction: Gazprom’s Ust-Luga project of 13 million tons and NOVATEK’s Arctic LNG-2 of 20 million tons.

This decision puts an end to Russia’s plans to become one of the world’s largest LNG producers, because the critical equipment for large-scale liquefaction is produced only in “unfriendly” countries. The implementation of projects already under construction is under question because the ban also applies to contracts that have been signed and paid for.

The European Commission has placed 21 Russian airlines, including Aeroflot, on its aviation security blocklist. These companies are banned from flying into airports of European Union states and over the community’s territory. The European Commission took this step “because they [the airlines] do not meet international safety standards... This decision reflects the concern that Russia has forcibly re-registered foreign-owned aircraft, allowing them to operate without legal airworthiness certificates.”

The state news agency TASS reported that Russia’s average daily oil and gas condensate production from April 1 to April 10, 2022, was 10.377 million barrels, down nearly 6% from March levels. At the same time, oil production in the first 10 days of April was 3.3% higher than in December.

Fighting sanctions

The Russian government decided to prepare for a budget crisis in advance and partially suspended the “budget rule” that defines the principles of using revenues from oil and gas production and exports. Now the Ministry of Finance will be able to use all oil and gas revenues to finance current expenditures during the year. According to the Budget Code, the National Welfare Fund (NWF) should accept all oil revenues exceeding the $44/barrel price level. When the government implements the norm of the anti-crisis law, the rest of the oil and gas revenues will go to the NWF after deducting all the expenses the government deems necessary to finance.

On the one hand, this decision is quite understandable and justified: It is better not to tie your own hands in a crisis. On the other hand, the government again admits that the “budget rule” does not work in a crisis—this was the case in 2008, 2014-15, and 2020. So it will be now.

The Bank of Russia seems to have acknowledged that the currency restrictions imposed were too harsh and led to an undesirable (primarily for the Ministry of Finance) effect: At the end of last week, the dollar exchange rate in exchange trading dropped to the level of late October (71 rubles/$), when a barrel of oil cost $82. Exporters are forced to sell the currency, and demand for it from importers has dropped sharply.

The decision played its part: By the end of Monday, the dollar had appreciably grown, exceeding 79 rubles/$.

The Bank of Russia published its annual report for 2021, which showed that the bank transferred a third of its dollar assets into yuan in the second half of 2021. The dollar share decreased from 16.4% to 10.9%, and the yuan’s share increased from 13.1% to 17.1%. As a result, the reserves of $29 billion were withdrawn from future sanctions. However, it is still unclear whether the Bank of Russia can use its reserves in yuan, and for what purposes.

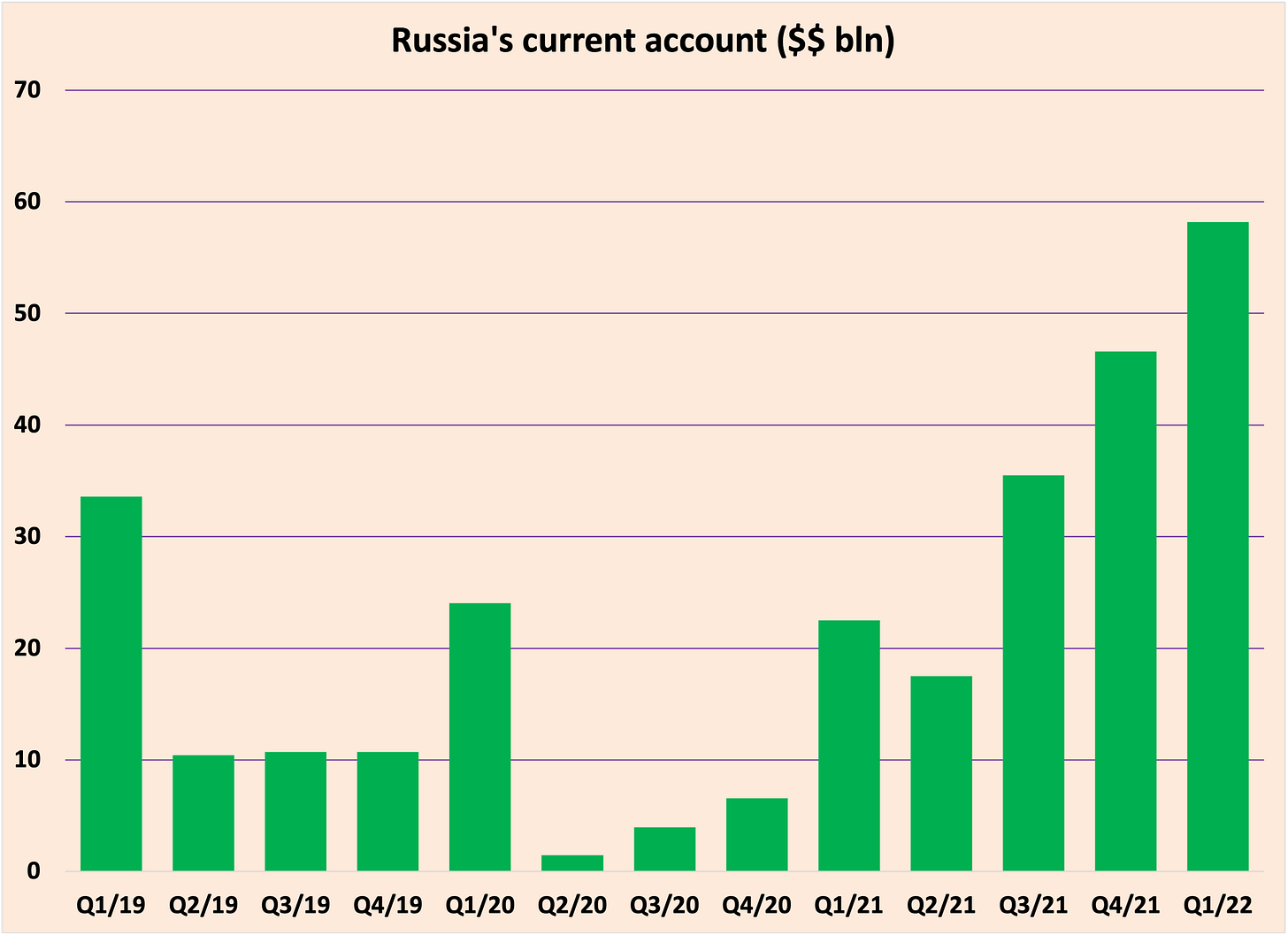

According to the Bank of Russia, the current account surplus of the balance of payments in the first quarter of 2022 totaled $58.2 billion, which is 2.6 times higher than during the same period in 2021 ($22.5 billion). This should not surprise anyone since the prices of Russia’s main export commodity, oil, increased by 23% compared to Q4 2021.

The Bank of Russia has limited the number of statistics by not publishing monthly data on trade in goods for February and combining data on trade in goods and services in the quarterly balance of payments estimate. The motivation for this action is well understood: To make it as difficult as possible for “unfriendly countries” to assess the effects of sanctions and restrictions on Russian exports and imports.

We suffer but believe our president

A poll by the pro-Kremlin VCIOM center says that more than half of Russians believe that they will feel the effects of the shutdown of foreign companies in Russia: 12% say it will have a substantial impact, 23% say it will have a moderate impact. Almost the same proportion think it will have a weak effect (21%). Thirty-nine percent of Russians are confident that the departure of Western companies will not affect their lives.

However, they could not precisely say the consequences: 20% are confident that they expect shortages of many goods, 14% believe that they will face rising prices, 6% fear a decline in living standards, and 5% fear unemployment.

Eighty-five percent of respondents supported Vladimir Putin and said import substitution would save the Russian consumer market. One in five (20%) believe that Russian companies will be able to replace the products of foreign companies fully, 48% think this will be possible for most goods and services, and 17% believe that the success of import substitution will be limited. Only 9% of respondents believe the import substitution policy will not bring visible results. Young people aged 18-34 (18-24—16%, 25-34—14%) and residents of Moscow and St. Petersburg (16%) doubted the capabilities of Russian companies most of all.

Enough is enough

French group Société Générale is the first major European financial group to announce its departure from the Russian market: Its assets—Rosbank (11th by capitalization in Russia), as well as its insurance business—will be sold to Interros Group (owner—Vladimir Potanin, #55 Global Forbes, $26.4 billion).

Société Générale is among three European banks that have played an important role in Russia’s financial system. Until recently, Rosbank was the only bank with foreign capital that continued to increase its operations in Russia: Its capital has grown by more than a third since the beginning of 2020. Italian UniCredit (10th place) and Austrian Raiffeisen Bank (13th) have reduced their capital by 4% and 1%, respectively, over that time, by capitalization among Russian banks.

Citibank, the largest U.S. bank operating in Russia, ranks 27th. About a year and a half ago, Citibank decided to stop its operations in Russia, but no buyer could be found. Over the past two years, the capital of the Russian Citibank decreased by 8%.

Do not use this word

On March 15, the police detained Anastasia Parshkova, who had attended an anti-war picket gathering with a placard reading: “The Sixth Commandment. Thou shalt not kill.” (In the Orthodox Church, this is the Sixth, not the Fifth.)

On April 9, a St. Petersburg court fined Artur Dmitriev 30,000 rubles (50% of the average Russian salary) based on the article “public actions aimed at discrediting the Russian military.” On April 7, Dmitriev had gone to an anti-war picket event holding an A4 sheet of paper with the following words: “The war brought so much grief that it is impossible to forget it. There is no forgiveness for those who once again plot aggressive plans.” The phrase for which Dmitriev was detained was said by the President of Russia on May 9, 2021, during the Victory Day parade on the Red Square.

On April 10, the police detained Konstantin Goldman, who stood at the pedestal of the Hero-city of Kyiv in the Manezh Garden near the Kremlin, holding in his hands the book War and Peace by Leo Tolstoy.