The soft lockdown is over. Getting ready for the next

Since Monday, the “non-working days” regime associated with the COVID outbreak has ended almost throughout Russia. But not because the pandemic was suppressed. According to the Russian Chief Sanitary Doctor, Anna Popova, during the past week, the number of cases increased in 61 regions (out of 83), with a steady decline in six (including Moscow, the Moscow Region, and St. Petersburg). The number of deaths, according to operational data, continues to grow and on Monday exceeded 1,200. Given that excess mortality is about three times higher than operational data, the level of the total death now exceeds 100,000 per month.

The vaccination rate for the first component is slightly over 42.5%. In Russia, the number of specially equipped medical beds continues to increase—over the past 10 days, their number has grown from 293,000 to 302,000.

The adverse situation is beginning to worry Vladimir Putin. Today he devoted a substantial part of the meeting of the Russian Security Council (a kind of Politburo) to this topic. Deputy Prime Minister Tatyana Golikova, Minister of Health Mikhail Murashko, Head of Rospotrebnadzor Anna Popova, and Moscow Mayor Sergey Sobyanin were invited. This group of people determines the whole strategy of the authorities’ actions and understands to the greatest extent what is really happening in the country.

Although the soft lockdown is over, there is no certainty that the authorities could turn the tide. So, Sergey Sobyanin said that although the number of sick and hospitalized people began to decline, a certain change in the number of deaths has not yet occurred. He announced that a “soft lockdown” is maintained in Moscow. In this mode, at least 30% of employees of all companies will have to work remotely, and for those over 60 years old and people with chronic diseases, forced self-isolation will remain. “We will look at the indicators at the end of the week, and based on the analysis, we will make a decision on further measures,” the mayor said.

Daily number of Covid deaths in Moscow

In almost all regions of Russia, the service sector operates with severe restrictions—many shops, cafés, restaurants, and cinemas can only be accessed with QR codes proving vaccination.

Moscow and the Moscow Region are the most populous regions in Russia. Their total area is 0.15% of the entire country, and 13.7% of the population lives there. The dynamics of the pandemic in this region plays a decisive role. Therefore, the reduction in incidence there is a leading indicator of what will happen throughout the country in the coming weeks.

But there are long New Year holidays ahead in Russia, which will last from January 1 to January 9. A slowdown in vaccinations in the second half of December and a new pandemic outbreak toward the end of January seem inevitable.

Belarus wants to compensate for damage from sanctions

A crisis has developed on the Belarusian-Polish border—thousands of people, refugees from Middle Asia and the Middle East, approached the Polish border from the Belarusian side and did not leave the border zone. Some of them tried to enter the territory of Poland, breaking the barbed wire fence.

It seems that how and why these people got to the territory of Belarus is clear to everyone. For those who have not yet understood this, Sergey Lavrov, Russia’s Foreign Minister, openly explained today: “…Refugees in the European Union…should be treated in the same way and the approach should be the same. Yesterday, at some political science discussions, they said: ‘Why, when refugees came from Turkey, the EU allocated funding to remain on the Turkish Republic territory. Why is it impossible to help the Belarusians as well?’” he said.

The economy of Belarus is beginning to feel the consequences of the last round of sanctions, imposed in June. These sanctions were extended to the Belarusian exporters of petroleum products and potash fertilizers. President Alexander Lukashenko, obviously, has no hopes for quickly lifting the sanctions. So, he decided to compensate for the losses from the sanctions with subsidies from the European Union.

Not a bad idea?!

Gas in the fog

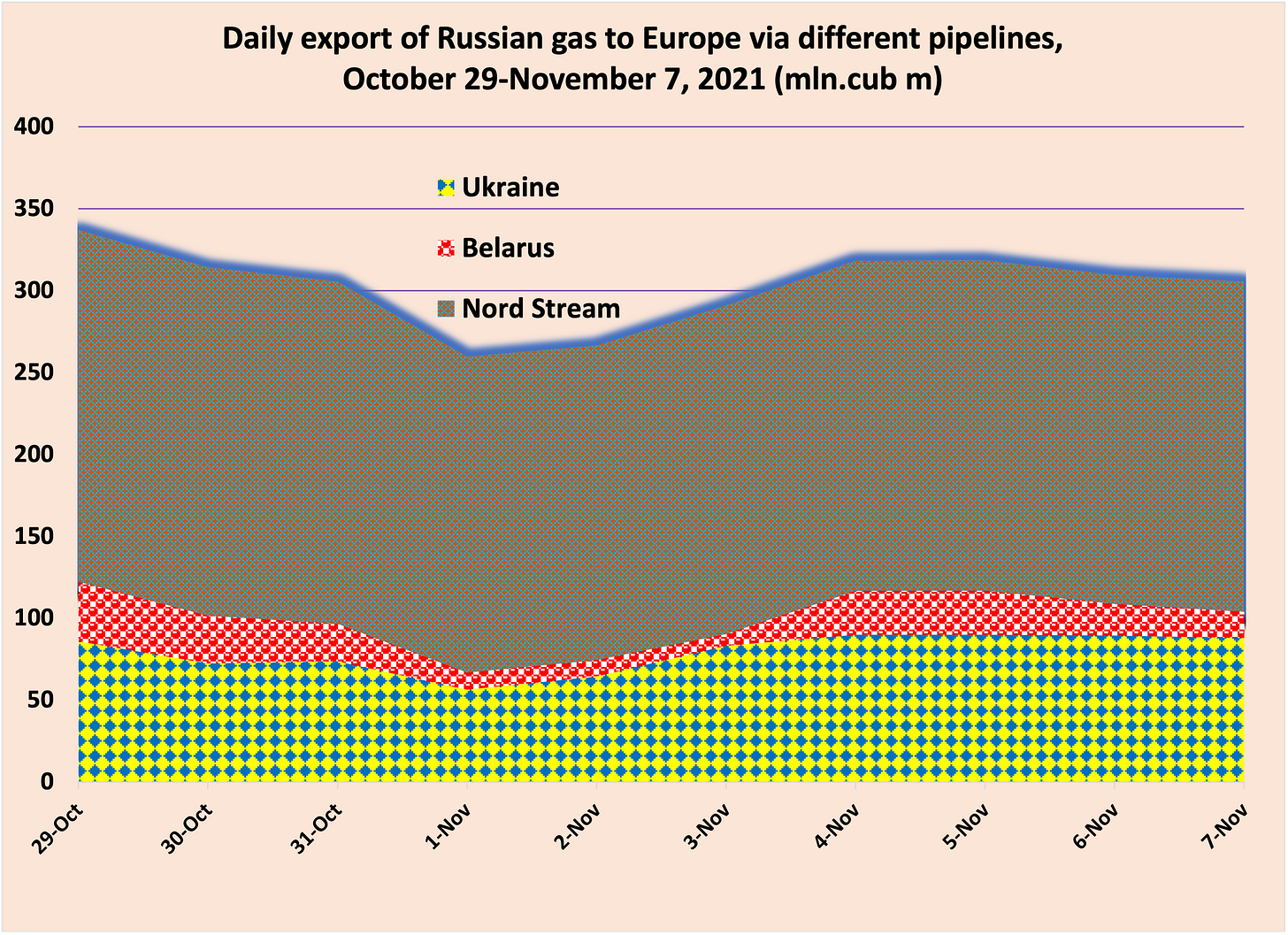

The situation with Russian gas supplies to Europe is becoming more and more clouded. Today, various Russian news agencies began to report that Gazprom has increased gas supplies to the EU countries. For confirmation, they cited scattered data for individual days, which did not add up to a coherent picture.

Sebastian Bleschke, Executive Director of the German Association of Underground Gas Storage Operators (INES), spoke in unison with the Russian media. He said that Gazprom’s promises to pump gas into its European storage facilities are being fulfilled—the filling level has been increasing since November 6.

However, these claims are not supported by other data. Thus, according to the Regional Booking Platform and GSA Platform (platforms for booking capacities of European gas pipelines), Gazprom did not book additional gas transit capabilities through Poland and Ukraine on Wednesday.

Moreover, Gazprom’s data on gas pumping to EU countries show that the total volume of Russian gas exports has even slightly decreased. And the positive data of the Russian media on the growth of transit are statistical tricks—the data for November 1, when the volumes of gas pumped through Ukraine and Belarus were minimal, were taken as a point of comparison.

It’s time to call Batman!

Deputy Minister of Agriculture Oksana Lut demanded that regional administrations increase the purchases of mineral fertilizers. According to the Ministry, the total volume of contracts for the next year is 20% less than this year.

The Ministry fears that the low level of purchases will increase export quotas (today, they are calculated as the difference between production and purchases of agricultural companies). In this case, next spring, there will be a shortage of fertilizers on the market, and the harvest may decrease by 10%-15%.

The rise in gas prices in Europe has led to an increase in the price of nitrogen fertilizers. This was the reason for the introduction of export quotas starting December 1. Farmers claim that the cost of nitrogen and complex fertilizers in Russia has grown 2.5 times compared to last year, to the level of European prices. However, farmers cannot transfer the increased costs into their prices, as they are limited by export duties on agricultural products.

The Ministry of Agriculture intends to allow the regions to conclude agreements with fertilizer producers with fixed volumes. In this case, the companies will set the price until May 31—that is, until the quotas expire. The Ministry is not discussing who will compensate for the lost profits to producers. In addition, it is not yet clear how big the producers’ check will be.

Russia sponsored the energy crisis in Europe. Now, this crisis is pulling Russia into itself. President Putin convened a meeting with members of the government for November 10. The plan includes “measures to prevent the negative impact of the energy crisis on the Russian economy” and “supply of foodstuff for the domestic Russian market.” I heard something very similar in 1990 at the meetings of the government of the Soviet Union…

Russia does not need American uranium

The attempt to penetrate the American market by the Russian nuclear corporation Rosatom has come to an end. Uranium Energy Corp has reached an agreement with Uranium One Investments Inc., a subsidiary of Uranium One Inc. (owned by Rosatom), to acquire all of the issued and outstanding shares of Uranium One Americas (U1A) for $112 million in cash and $19 million in the form of debt obligations. For the buyer, the deal is very profitable—the acquisition price equals 12% of the current value of the company.

In 2009-2103, after a series of transactions, Rosatom became the sole owner of Uranium One Inc., which owned uranium mines in Kazakhstan and the United States. Mining in the United States lasted from 2011 to 2017, accounting for 20% of the total uranium production in the United States at its peak. In 2019, production was suspended due to very low prices for uranium in the world market and the high costs of U.S. technology.

Rosatom claims that the sale is part of Uranium One’s strategy to optimize its asset portfolio and increase economic efficiency. Moreover, back in 2009-2011, many experts anticipated that the primary goal of Rosatom was Kazakh assets, and the American mines were sold by the former owners “in a package.”

In the spring of 2015, on the eve of the presidential election, the American media actively discussed the history of the purchase of Uranium One and the role of then-candidate Hillary Clinton in it. The New York Times and The Wall Street Journal reported that Uranium One chairman Ian Telfer donated $3 million to the Clinton Global Foundation in the spring of 2008. Two-and-a-half years later, when the U.S. authorities considered the deal between Rosatom and Uranium One, Clinton was among the decision-makers to agree on it. The former head of the Board of Directors of Uranium One, Telfer, said that he donated to the Clinton Foundation long before Rosatom became interested in buying the company. These two events are in no way connected, in his words.

Putin’s hands are untied

In the first reading, the State Duma of Russia adopted a law abolishing the restrictions on the length of the governors’ tenure in office. The current norm stipulates that the term of governors’ office is no more than five years, and the governor may not be elected more than twice to his post.

This amendment does not make severe changes to the internal structure of Russia. The country is officially called the Federation, and the federal system is fixed in the Constitution. But already during his first presidential term, Vladimir Putin gave himself the right to remove governors. After the terrorist act in Beslan in September 2004 (the seizure of a school with 1,100 hostages, during the storming of which 333 people were killed), he got the right to appoint them. In Dmitry Medvedev’s era, powerful political protests at the end of 2011 pushed him to return to the governor elections. However, just a few months later, Putin introduced amendments to the law that severely limited the possibility of electing politicians who did not receive the Kremlin’s approval. Since 2012, more than 200 elections of governors of various regions have taken place in Russia. Only five times have candidates publicly endorsed by Putin lost.

In fact, the change in the law removes restrictions on Vladimir Putin. The Russian president does not like to replace officials to whom he is accustomed and about whom he has no complaints. The strict limitation of the governors’ tenure in office forced him to dismiss governors for legal reasons. Now there will be no such restriction.

Putin’s hands are untied. And on this issue too.

Outcome of quasi-elections

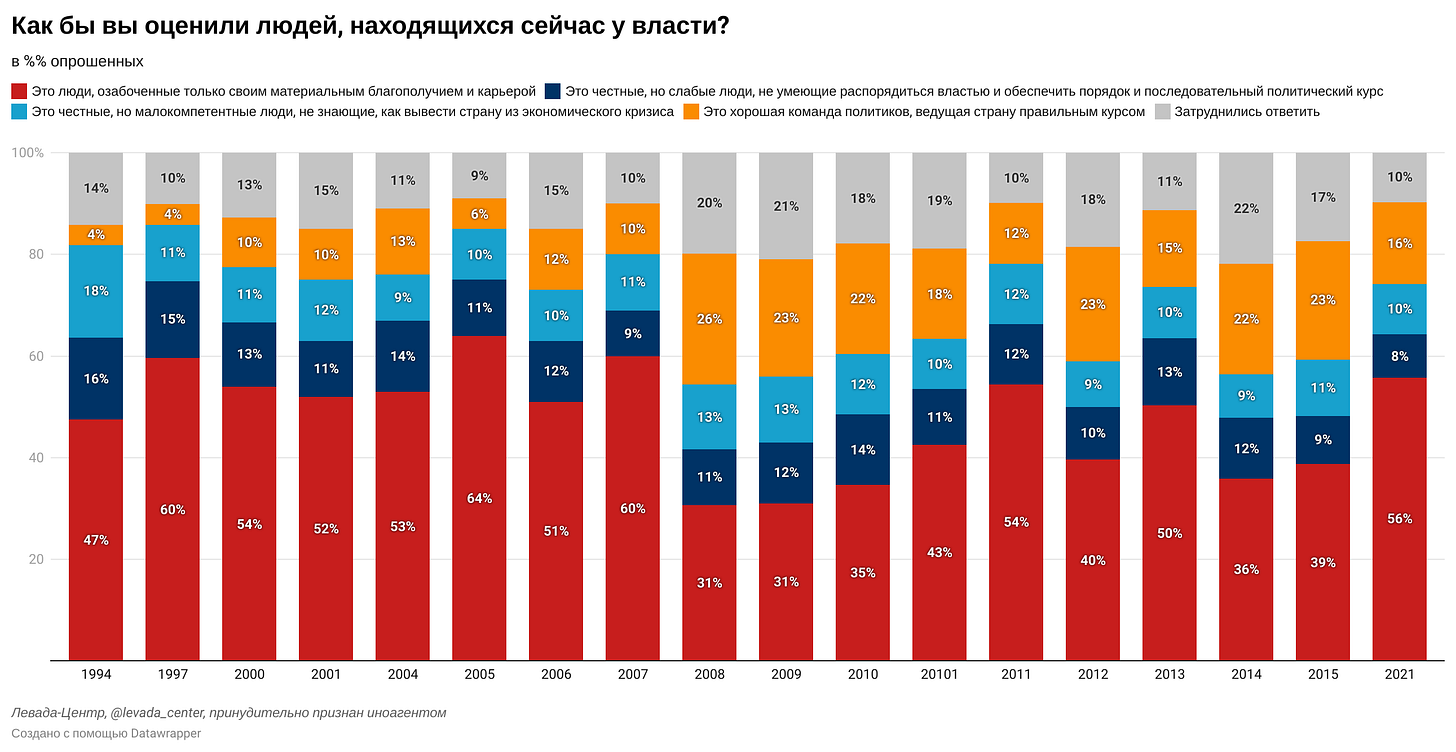

A poll by the Levada-Center showed that Russians are pretty skeptical about Putin and his team. Only 16% believe that Putin’s team consists of knowledgeable and competent politicians leading the country on the right course. 18% consider them weak, incompetent, and incapable of leading the country out of the crisis. More than half of Russians (58%) believe that members of Putin’s team are solely concerned with issues of personal well-being or career considerations.

This poll clearly shows what the results of fair and free elections in Russia could be. I think after that, you understand why Putin does not want this.