July 14, 2022

We shell with what we have. We hit where it happens

Someone is paying

The Kremlin bowed to pressure a little

President knows!

Ritual dancing

Unexpected competitor

Silver in the clouds

Fighting sanctions

The law of the bureaucrat: Don’t make decisions, ask for more money

We shell with what we have. We hit where it happens

After taking a brief pause in its offensive, the Russian army decided to compensate for its “softness” by intensifying its rocket attacks on Ukrainian cities. Every day Russian rockets fly into the centers of major cities, destroying civilian buildings. According to military experts, the Russian army uses missiles of old modifications, which are not designed for target shooting. Today the center of Vinnytsia was hit by “Caliber” missiles: a concert hall named “Home of Officers” (Dom ofitserov), a business center, a parking lot, and a medical clinic, killing more than 20 people.

A week ago Ukrainian MoD reported that Russia used the S-300 air defense complex, modified to shoot at ground targets while hitting Mykolaiv.

Someone is paying

Russian regions report one after another about recruiting volunteers for the war in Ukraine. The process organizers are local veterans’ organizations, which promise to pay potential volunteers 250,000 rubles on top of the money they will receive from the Defense Ministry. But the organizers make no secret that they get the money for the payments to the volunteers from the regional leaders.

Here is what the Chairman of the association “Veterans of paratroopers and special forces of the Republic of Bashkortostan” said about it. Marat Adigamov, announcing the creation of the second volunteer battalion in the republic:

There is already a preliminary agreement that the participants will enjoy all the preferences, financial support, and other measures that are provided for the first battalion as well. Without the support of the government [of the Republic of Bashkortostan], we would not have made such a proposal.

However, I’m not sure that payments to volunteers are officially provided for in the regional budget. Most likely, the local administration collects “patriotic donations” from businessmen, which are not reflected in either budgetary or veterans’ organization reports.

The Kremlin bowed to pressure a little

In Istanbul, Russia and Ukraine ended negotiations, mediated by Turkey and the United Nations, on the resumption of exports of Ukrainian agricultural products. According to the Ukrainian authorities, the country has accumulated more than $5 billion worth of food stocks that cannot be shipped out of Ukrainian ports because the Russian navy blocks them, and Russia and Ukraine mine the coastal waters. Ukraine is the world’s largest exporter of sunflower oil and one of the top five grain exporters. Ukrainian companies accounted for approximately 50% of China’s grain imports in 2021. In April-May 2022, the volume of Chinese imports from Ukraine fell 12-13 times.

UN Secretary-General António Guterres discussed the issue of Ukrainian food exports with Vladimir Putin in April; African Union President Macky Sall came to the Kremlin in June to discuss this topic; Turkish President Recep Tayyip Erdoğan regularly talks to Putin about this issue. Until recently, the Russian authorities refused to discuss the problem, saying everything depended on Ukraine. But consistent pressure on the Kremlin has led Russia to soften its stance. Russia’s key demand—to ensure that grain carriers cannot be used to deliver weapons to Ukraine—has been met by creating a special group of Turkish and UN representatives to inspect vessels bound for Ukrainian ports.

President knows!

In the near future, the remaining issues between the sides will be resolved, and Ukrainian food will go to consumers. The President is aware of the situation. Russian Prime Minister Mikhail Mishustin has confirmed that the appointment of Denis Manturov as Deputy Prime Minister was dictated by Vladimir Putin’s desire to deal with viscid bureaucracy. Mishustin said the government must ensure that Russian industry is kept from a serious decline and “in a short time to ensure the transition to its production of goods necessary for the country.”

Now, in the context of unprecedented sanctions, a high speed of decision-making and their further implementation is required. After all, industries are affected by various restrictions and bans. It is necessary to react as flexibly as possible to the current dynamics.

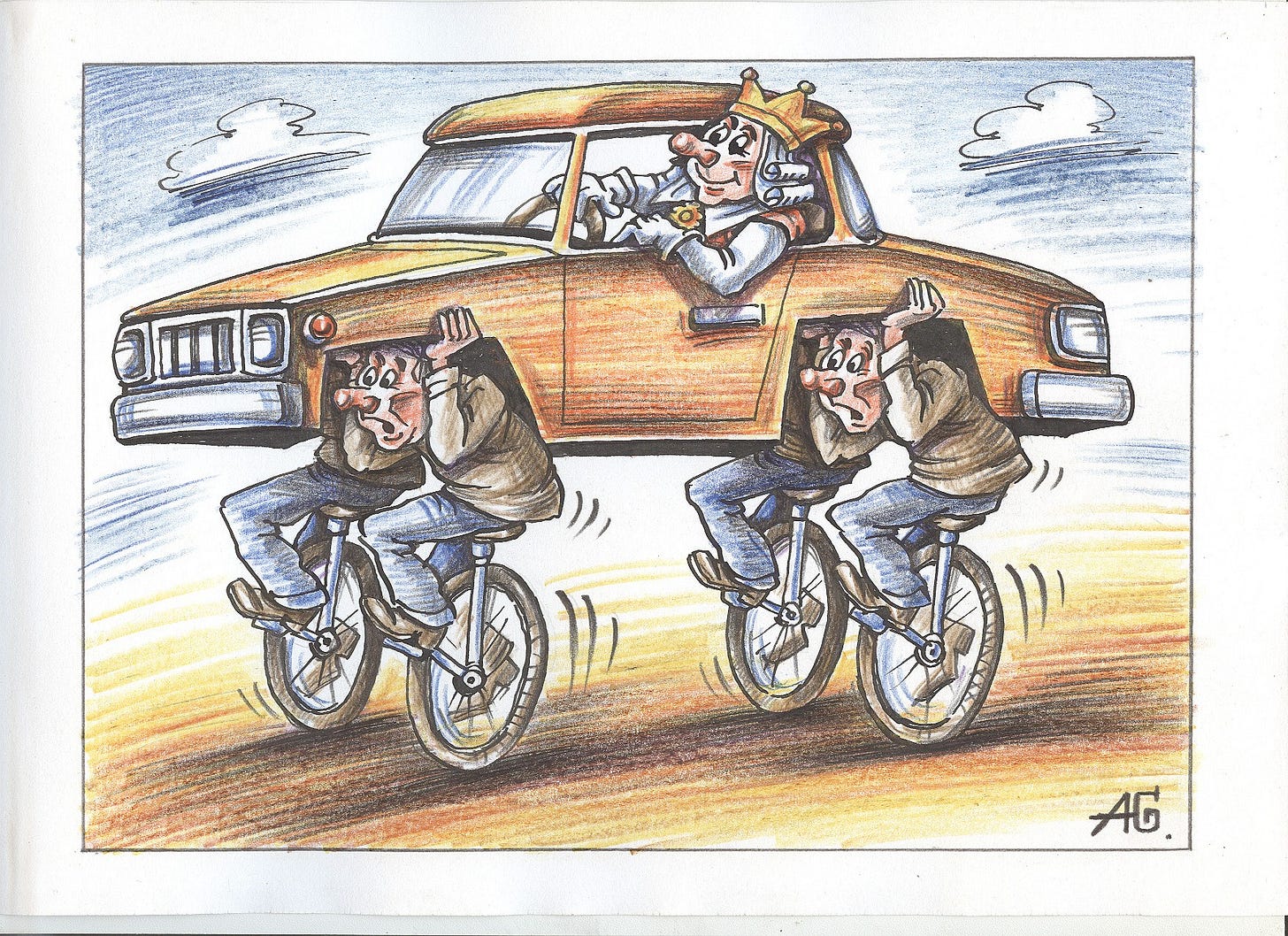

Ritual dancing

The State Duma is likely to unanimously support the appointment of the new Deputy Prime Minister, but this does not mean that Manturov does not need to perform “ritual dances” in front of the deputies. Today’s most painful topic for the Russian industry is the almost-complete shutdown of automobile companies. In May, car production dropped 33 times compared to last year, but Manturov can’t hold out any hope of global companies returning to Russia. He can, however, promise new investors from China. The press service of the Ministry of Industry has informed him that Russian electric cars will start going on sale in September. The cars will be produced in Lipetsk and will be an exact copy of the Chinese Sokon SF5.

However, it would be wrong to say that this project will pull the Russian auto industry out of the pit: 242,000 cars will be produced by 2033—i.e., 22,000 a year. To keep the deputies’ spirits up, Denis Manturov has some more good news for them: His ministry has found money to subsidize the purchase of almost 80,000 cars on credit. After sales of new cars in Russia dropped 4.5 times in June compared to last year, Manturov promised to help buy every second car that will be sold in the second half of the year (if June sales remain the same, 27,761 cars).

Unexpected competitor

In his new position, Denis Manturov will have to face new problems. One of them is competition from Kazakhstan, which has decided not to help Russia in difficult times and, on the contrary, has decided to make Russia’s problems even worse. Kazakh President Kassym-Zhomart Tokayev demanded that the government prepare favorable conditions for the repatriation of foreign businesses that have stopped working in Russia to Kazakhstan.

We are witnessing a global struggle for investment capital. Almost 1,400 big foreign companies stopped their activity every second or left the Russian market completely. The government should create favorable conditions for their repatriation to Kazakhstan. This will give us opportunities to increase production of medium- and top-end goods.

Speaking at a government meeting, Tokayev rebuked his ministers, saying that work to attract international investors was very sluggish.

I instructed the government to prepare a pool of investment projects in the manufacturing industry and work it out with potential investors. This work is still being done in the mode of meetings and appointments. In terms of concrete results, there is little to brag about so far. There are essentially no new projects.

Silver in the clouds

Analysts at the Bank of Russia continue to argue that the Russian economy has moved into the stabilization stage. According to their estimates, “operational indicators show that the Russian economy is going through a relatively smooth first stage of adjusting to the changed external conditions. In May-June, the decrease in economic activity stopped.” However, this was the end of the experts’ optimism. Trying to analyze the economic dynamics in individual sectors, they stated that “the dynamics in the sectoral breakdown remain uneven. In manufacturing (mainly due to the dynamics of the metallurgical industry and machine-building) and transport services, the decrease in output in May was accelerating.”

Every cloud has a silver lining, as the saying goes, and the Bank of Russia seems to have recalled this. They found the “silver” because the Russian economy was cut off from a considerable part of modern goods and components. After analyzing the structure of the Russian economy, Bank of Russia analysts happily reported that its dependence on intermediate imports—i.e., imports of components—is deficient; in the list of 66 countries, data collected by the OECD, Russia ranks 64th. Experts say bluntly that “this is due to the low involvement [of Russian companies] in complex global production chains” but find reason to be optimistic—“The scale of supply-side constraints in a significant number of industries may be relatively small.”

Analysts acknowledged that this dependence on the Russian economy is at a much higher level and that “the level of the economy’s potential and future growth depends largely on the success of overcoming investment import restrictions.” But again, that silver lining: “Restrictions on its [investment equipment] supply are not affecting the economy’s current potential as quickly.”

Fighting sanctions

First Deputy Chairman of the Bank of Russia Vladimir Chistyukhin admitted that the division of Russian banks into sanctioned and non-sanctioned is a serious problem because “banks under sanctions are the largest Russian players, which occupy the main share of the market.” At the same time, the main task of the Bank of Russia, according to Chistyukhin, is to limit the competitive opportunities of banks that are not under sanctions: “...it would be wrong to create any preferences in favor of non-sanctioned participants.”

Moreover, judging by his words, the Bank of Russia will create and impose special mechanisms on banks that have not been hit by sanctions, which will allow masking their cooperation with those that have been hit by sanctions. One such mechanism could be the creation of intermediaries that would mix the resources of both groups of banks, depriving borrowers of the opportunity to refuse to work with banks hit by sanctions.

... the time has come to develop syndicated lending in all types and forms. To this end, appropriate legislative changes are being prepared. An important approach is also the development of platform services and marketplaces when the consumer often does not go directly to the service provider but does it through a platform. This levels the playing field for sanctioned and non-sanctioned marketplaces.

The law of the bureaucrat: Don’t make decisions, ask for more money

After the Russian government bought 68% of Russia’s largest car company, AvtoVAZ, from Renault for 1 ruble, former Transport Minister Maxim Sokolov was appointed its General Director. Two months later, Sokolov gave a big interview in which he skillfully combined a story about the company’s excellent prospects (something Vladimir Putin wanted to hear) with knowledge of the Russian proverb that only a fool with initiative can be worse than a fool. Sokolov talked about the great cars that AvtoVAZ will produce but stated very clearly that this would require huge sums of money to be allocated to the Russian budget. And more importantly, he does not intend to take any responsibility for approving the company’s development plans.

- You mentioned the new strategy of AvtoVAZ; what are its main parameters?

- ...in this matter, we should move sequentially: First of all, we should work out a general strategy for developing the automobile industry in the country. As you know, at the meeting under the President, it was commissioned to work out a new strategy for the automobile industry by autumn... [AvtoVAZ’s strategy] will be an integral part of the general strategy of the Russian automobile industry because AvtoVAZ has always been and remains the flagship of national automobile production. I am sure it will play this role in the new development strategy in the future.

- What new models should we expect from AvtoVAZ?

- The question of the prospects for new models is always on the agenda. We do not stop our work in this direction, even for a moment. After approval of the new strategy of AvtoVAZ, we will actively begin to develop new models... our customers justifiably want to drive modern cars, so AvtoVAZ faces the challenge of deep localization to achieve technological supremacy in the automotive industry. This will require investment from AvtoVAZ and our suppliers, partners, and automotive component manufacturers. Of course, we also count on state support...

- How much are we talking about?

- It’s too early to give any figure yet, but this volume corresponds to the trends in the global automotive industry. There’s no need to reinvent the wheel, so the order of figures is generally straightforward.