July 25, 2022

Sanctions as usual

Rockets to grain are not a hindrance

Close to the Crimean scenario

One more step forward

Mau’s case is alive

There is no war

A hard-to-follow plan

Sanctions mosaic

When politics determine the economy

Sanctions as usual

As part of the seventh sanctions package, the European Union has taken one step forward and two steps back. On the one hand, there is an embargo on purchases of Russian gold by European companies; on the other hand, European companies are allowed to transport Russian oil to non-European markets.

The ban on the purchase of gold does not seem to be a significant step: In 2021, Russia exported 90% of the gold produced (302 tons), for a total of $ 17.4 billion, which amounted to 3.5% of Russian exports. Even a complete stoppage of gold mining and production would not be a severe blow to the Russian economy because these processes are not tied into long technological chains. On the other hand, the Russian authorities have a straightforward way to eliminate the embargo’s impact—you need the Bank of Russia to act as the ultimate buyer of gold for the producing companies. The cost for the Bank of Russia to buy all the gold produced in the country (at current gold prices and the current ruble-dollar exchange rate) will be about 1 trillion rubles a year, equivalent to 5% of the broad monetary base. Over the past 10 years, this indicator has grown to 11 trillion rubles—i.e., such parameters of the operations of the Bank of Russia are pretty in line with its monetary policy. Besides, we should not forget that the Bank of Russia had mastered the instruments of absorbing excessive ruble liquidity from the banking system by the second half of the 1990s.

In a word, the embargo on purchasing Russian gold sounds nice, but it will have no effect. However, the waivers given to European transport companies (and the Russian Sovcomflot) will make the export of Russian oil to Asian markets cheaper and reduce the current Asian byers’ discounts buyers (#30-$35/bbl). That is, the announced changes in the sanctions regime will increase revenues for the Russian economy and the Russian budget.

Rockets to grain are not a hindrance

On Friday last week, two agreements emerged to organize Ukrainian food exports: The first was signed by Ukraine, Turkey, and the UN; and Russia, Turkey, and the UN signed the second.

Ukraine is the largest supplier of sunflower oil, with a share of more than 40% in recent years, the fourth-largest supplier of corn to the world (12%-16%), and the fifth-largest supplier of wheat (8%-10%). The country had a record harvest last year, and up until February, food exports were 40%-50% higher than the previous year. After the invasion by the Russian army, Ukrainian ports were closed to civilian traffic, and exports fell to almost zero in March. In May and June, Ukraine was able to establish food exports through alternative channels (railroads and river transportation on the Danube), but they did not allow exports of more than 1 million tons per month. As a result, by the end of the agricultural year (June 30), Ukraine had about 16 million tons of grain that could not be exported (10 million tons of corn, 5.5 million tons of wheat, and 0.5 million tons of barley).

The day after the agreements were signed, Russia launched a missile attack on the port of Odesa. A short time later, Hulusi Akar, the Defense Minister of Turkey, a guarantor of the agreements, said Moscow had “nothing to do with it,” citing his contacts with the Russian military.

During our contact, the Russian side told us that it had absolutely nothing to do with this attack and that the Russian Federation was looking into the matter very carefully and in detail.

However, as early as Saturday, the Russian military admitted that it was Russian missiles and that the Russian army succeeded in destroying a Ukrainian military boat. On Sunday, the Russian Foreign Ministry said the missile strike targeted the port’s military infrastructure.

On Monday, Russian Foreign Minister Sergei Lavrov clarified that Russia would continue to launch missile strikes against facilities in Ukrainian ports that it considers military. According to Lavrov, this is not an obstacle to grain exports from Ukraine.

“The grain terminal of the port of Odesa is at a considerable distance from the military part, there are no obstacles for the grain under the agreements signed in Istanbul to begin to be delivered to customers, and we have not created them.”

Ukrainian experts believe that the maximum capacity of grain export terminals in Ukraine is about 5 million tons per month. Still, it is unlikely that they can be used for more than a third of that under the conditions of military operations.

Close to the Crimean scenario

At the end of June, the occupation administration of the Kherson region created its tax service, which began registering companies and entrepreneurs and collecting taxes. A month passed, and it became evident that the actual management of the tax service in the occupied territory was carried out by the Russian tax service: Company registration was implemented using similar procedures; moreover, in recent days, businessmen began to receive refusals to register companies if they presented Ukrainian passports, thus forcing them to apply for Russian documents.

Failure to register a company under the rules established by the occupation authorities results in companies being blocked from operating and their owners and managers being warned of the possibility of criminal prosecution.

Coercion to obtain Russian passports was used by the Kremlin during the annexation of Crimea: Then, a special law was adopted that declared all residents of the peninsula Russian citizens; to renounce Russian citizenship, a particular application under a complicated procedure had to be submitted. This technology is not yet (!) applicable in the Kherson oblast (and Zaporizhzhia oblast), because no law on annexing these territories was passed in Russia. But I do not doubt that the Kremlin technologists will find other ways to force Ukrainian citizens to obtain Russian documents (receiving pensions and salaries in budgetary organizations, obtaining cell phone services, and opening bank accounts).

One more step forward

Almost at the same time, the Russian occupation administrations operating in the occupied parts of the Kherson and Zaporizhzhia regions of Ukraine announced the creation of electoral commissions to hold referendums on the future of these territories. The timing of the referendums and the exact wording of the questions have not yet been announced. Still, we should expect that they will appear soon: The synchronicity of the decisions to create electoral commissions suggests that they are part of the Kremlin’s action plan. Because President Putin likes to approve plans, according to which his subordinates should work and report, and First Deputy Head of his Administration Sergei Kirienko knows how to make such plans, I have no doubt that the entire sequence of actions is written in them.

Mau’s case is alive

The district court of Moscow put under house arrest Russian Academy of National Economy and Public Administration Vice-Rector Ivan Fedotov, Vladimir Mau’s deputy, suspected of embezzlement by fraud. At the court hearing during the decision to arrest Mau, it was said that the charge against him was based on the testimony of former Deputy Education Minister Marina Rakova and the materials of operative-search activity, in particular telephone correspondence.

There is no war

Chairman of the Bank of Russia Elvira Nabiullina said that the restrictions on withdrawal of cash foreign currency from bank deposits, which were introduced in March for six months, would be extended indefinitely. Nabiullina lied when she called Western sanctions the cause of the situation, forgetting to mention the reasons for their imposition.

... we now have no reason to expect that the situation with the flow of foreign currency in cash into the country will change for the better shortly. Those decisions of unfriendly countries... to prohibit the entry of foreign currency in cash into Russia remain in force. At the same time, our banks must be able to ensure for all citizens their rights to previously opened foreign currency accounts and receive the amount within the allowed limit of $10,000. And so in September, we will be forced to extend those restrictions, which we imposed in early March.

A hard-to-follow plan

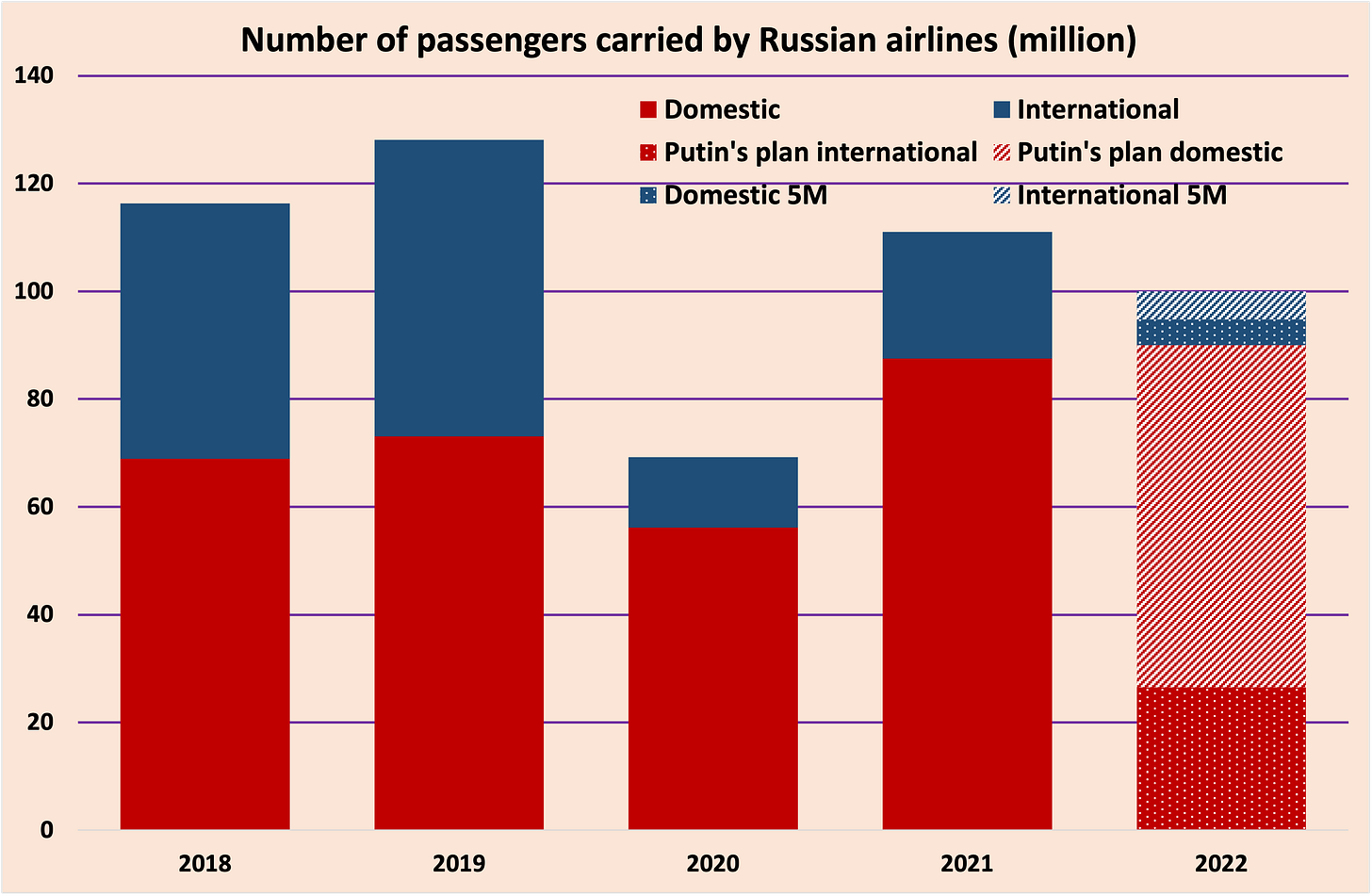

Immediately after Russia invaded Ukraine, the Federal Air Transport Agency banned flights to 11 airports in Southern Russia for security reasons, significantly limiting Russian flights to Black Sea resorts: Flights go only to Sochi/Adler. According to estimates by the Ministry of Transport, by July 1, Russian airlines lost 6.3 million passengers. If the southern airports do not open before the end of the year, the number of failed flights will exceed 19 million (21.8% of the number of domestic flight passengers in 2021).

On March 31, Vladimir Putin planned for Russian airlines to carry 100 million passengers this year. Transport Minister Vitaly Savelyev said that 90 million passengers would be within Russia and 10 million on international flights. Today Vladimir Putin discussed air traffic with government members, but judging by his remarks, he has not received information about the actual situation.

The task of increasing the volume of domestic flights and making them more accessible to citizens indeed remains one of the critical tasks, both for this year and in the future... the aviation industry must be ready for a rapid recovery of services. Domestic consumer demand is now actively recovering, and as it always has been, this will be accompanied by an outstripping growth in demand for air travel by our citizens.

I don’t have data on the dynamics of domestic demand for June (Vladimir Putin may have them), but in April and May, Russian households’ demand for transportation services fell by 7.2%-7.5% and for non-food goods by 17%-17.5%.

Russian airlines carried 34.6 million people in the first five months of this year. Still, while in January-February, the average monthly number of passengers was 8.1 million, in March-May, it dropped to 6.15 million. To meet Putin’s plan, Russian companies must carry 5% more passengers in June through December than in the same period last year.

I don’t know about Putin, but I have little faith in it.

Sanctions mosaic

U.S. MARS, a significant Russian chewing gum market player, has encountered difficulties supplying this product under the Orbit brand: The rubber base made of synthetic polymers has fallen under European Union sanctions. MARS warned consumers that it would not be able to ship about half of its assortment by the end of the year, and a temporary supply restriction was imposed on the remaining half until the end of July.

At least seven projects to modernize power units of thermal power plants being implemented in Russia will not be completed on time, due to failures of Western turbine manufacturers or shortages of imported components. The capacities of the power plant units facing limitations range from 100 to 850 MW; a delay in their completion will not cause severe problems in the energy market.

“Norilsk Nickel” and Rosatom abandoned the project to build an icebreaker with a fuel plant running on liquefied gas—it is impossible to make such a propulsion system due to the sanctions.

In changing the project, it was decided to equip the icebreaker with a Russian engine; its testing was completed last year, but the engine has not yet been installed on any ship. In addition, the designers will have to give up Azipod propellers, manufactured by Swedish-Swiss ABB, which has announced its withdrawal from the Russian market.

Initially, the agreement stipulated that the first icebreaker of the joint project would be built in 2027. It is not yet known whether the change in the project will cause a delay in the icebreaker construction schedule.

Meanwhile, the Finnish company Aker Arctic, owned by Russian businessmen, has started building an LNG-powered icebreaker for Norilsk Nickel, to be delivered to the Russian company by the end of 2024.

Russian Prime Minister Mikhail Mishustin signed the decision to expand the list of “unfriendly countries” to include Greece, Denmark, Slovenia, Croatia, and Slovakia. Now the total number of unfriendly countries and territories is 56.

In addition, the government has restricted the ability of diplomatic institutions of these countries to hire Russian citizens. For Greece, the number is 34; for Denmark, 20; Slovakia, 16. Slovenia and Croatia will not be able to engage any Russians at all in their diplomatic missions and consulates.

When politics determine the economy

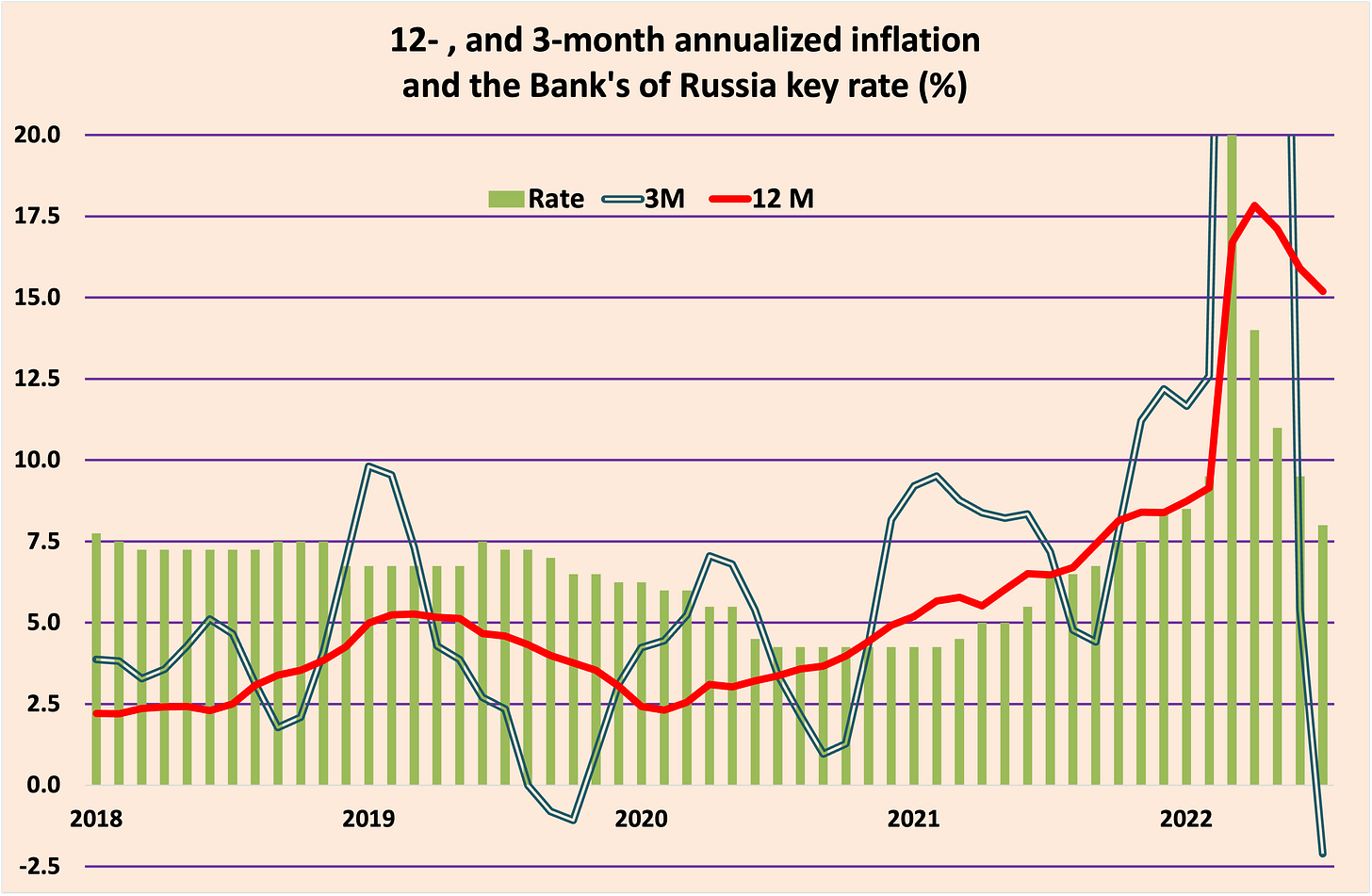

On Friday, the Board of Directors of the Bank of Russia made two contrary decisions: On the one hand, it sharply lowered its key rate to 8% from 9.5%; on the other, it raised the reserve ratio for ruble and foreign currency deposits. The first decision should symbolize the Bank of Russia’s desire to soften its monetary policy, while the second decision toughens it by limiting banks’ ability to lend. In my opinion, both decisions evolve from the current economic situation, and the Bank of Russia will make similar decisions in the future (the Board of Directors has already announced that reserve requirements will be raised in January and June next year). However, both decisions are political, so their effect will be mixed.

Current inflation in Russia is at zero, and the economy is in recession, which, according to the textbook, should prompt the central bank to ease monetary policy and lower the interest rate. However, the changes in Russia’s economy are caused by non-economic factors—zero inflation is caused by a sharp drop in households’ demand due to a decline in incomes, and the Western sanctions cause the economic downturn—and one should not expect the monetary authorities’ actions to counteract their effect.

On the other hand, if the Bank of Russia believes that the current inflation is objectively conditioned, then the rate at 8% is super-rigid, suppressing economic activity. In addition, any action of monetary authorities to soften or tighten monetary policy has an impact on the real economy with a lag of 9 months-18 months, and what will happen to the Russian economy in a year…no one today can predict convincingly. Therefore, it is complicated to say whether the decision to lower the rate is right or wrong. However, the Bank of Russia couldn’t avoid this decision because President Putin has enough economic knowledge to expect a rate cut when inflation is zero.

The Board of Directors explained the decision to raise the reserve requirements for two reasons: A persistent structural surplus of liquidity in the banking system and the desire to reduce the share of foreign exchange assets and liabilities on banks’ balance sheets (foreignization).

Suppose the Bank of Russia plans to increase the level of reserves are carried out. In that case, they will return to the levels they were before the coronavirus outbreak, and the volume of liquidity of Russian banks will decrease by 700 billion rubles. Considering that over the past five years, Russian banks deposited between 1.4 trillion and 4 trillion rubles with the Bank of Russia (including the purchase of its bonds), I wouldn’t count on the excess liquidity problem to be solved this way.

The desire to fight foreignization is due to the political situation only. After all, Russian banks normally existed with large amounts of foreign exchange assets and liabilities, and after the crisis in 2008, they learned to control and hedge currency risks. But after the Western countries blocked the Bank of Russia’s foreign assets, the Bank of Russia fears that the restrictions on the use of foreign assets may expand (who knows what else the Kremlin will arrange?!), which may lead to the freezing of a significant part of banks’ assets—i.e., to losses.

However, the level of foreignization is not very much dependent on banks: Russian banks’ own foreign assets are not very large; the main foreign assets belong to banks’ clients, companies, and households, and the maximum that the monetary authorities managed to achieve was to stop the process of building up foreign currency assets by the mid-2010s. For individuals and companies to prevent their savings in foreign currencies, the Bank of Russia has to come up with something extraordinary, but restoring mandatory reserves to the level of early 2020 is not.

And last but not least: The de-foreignization of the households’ and corporate savings and the de-foreignization of banks’ balance sheets implies replacing foreign currency assets with ruble ones—i.e., the sale of foreign currency and increasing pressure to strengthen the ruble. But a strong ruble has become one of the most severe challenges for the Kremlin and the economy.