June 22, 2022

Time to save?

More influential than Gazprom

...and more robust than the construction lobby

New gas attack

The new weapons “are not”

The decree surprised me

Going away the Swedish way

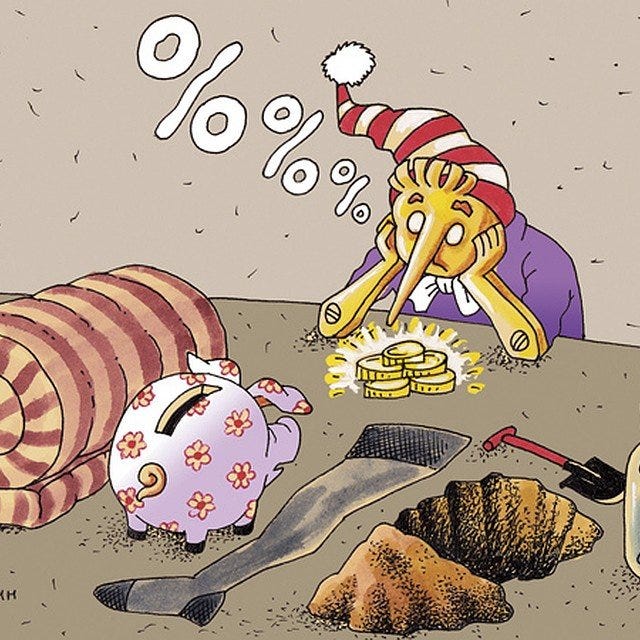

Time to save?

The Bank of Russia published the first data on the current situation in the banking sector, in which I found the expected and unexpected information.

Quite expected was that the demand for credit in the economy continues to decline. At the end of 2021, the corporate sector increased its indebtedness on loans by 11%, small businesses by 30%, and households by 23%. In March-May this year, the combined debt of the corporate sector and small businesses declined by 0.5%, while the government deployed several programs to subsidize interest rates for companies. According to the Bank of Russia, mortgage lending has virtually come to a halt: The volume of loans received at mortgage rates in April and May was 50 billion rubles (with the total mortgage portfolio amounting to 12.5 trillion rubles). The volume of consumer loans decreased by 3% in March-May.

I found some surprises in the savings behavior of the population: The Russians not only began to accumulate savings but also made a clear choice in favor of foreign currency deposits, which accounted for more than 60% of the growth in savings. Bank of Russia experts attribute this to the rapid reduction of ruble deposit rates and the reaction to the strengthening of the ruble in May, which households saw as short-term.

The growth of savings in a crisis and high inflation is not usual. In Russia, it can be explained by the fact that only 40% of Russian families with the highest income have financial savings, which, due to the sanctions, have been deprived of opportunities to purchase familiar goods and services: For example, foreign tourism fell by 90%, sales of new cars by 85%.

For the first time since the start of the war, Russian companies increased their savings in banks, which were divided almost equally between rubles and foreign currency. Bank of Russia experts note that nearly all the increase in savings was generated by exporting companies. This correlates well with the fact that in May, the average daily volume of currency sales on the Moscow Exchange was double that of March-April—i.e., the main impetus for the sale of currency was not the government’s order but the market situation, the rapid appreciation of the ruble.

More influential than Gazprom

The Russian Finance Ministry deemed it unfair that all of Gazprom’s profits from higher gas prices in Europe were divided between the company and the regional budgets (which receive income tax). Even Gazprom’s enormous dividend payments have not improved the public’s mood. As a result, the government submitted a bill to the State Duma to increase the extraction tax rate, which could increase budget revenues by over 400 billion rubles between September and December of this year.

The tax hike will not be a problem for Gazprom: Experts estimate that its profits will fall by less than 10%, although much will depend on whether the company can restore exports to Europe, which have fallen due to the suspension of one of the branches of the Ukrainian gas pipeline and the reduced capacity of Nord Stream because of the sanctions in Canada.

The Ministry of Finance has begun to monitor the state of the budget more closely. Although the federal budget recorded a considerable surplus for five months, an increase in the current year’s expenditures due to accelerated inflation should be made public soon. According to Minfin’s forecasts, this year’s federal budget will demonstrate a small deficit. Still, the potential reduction in energy exports in the year’s second half makes us pay closer attention to all the opportunities to increase revenues.

Careful focus on budget balance is a characteristic feature of the economic policy of Vladimir Putin, who came to power shortly after the severe financial crisis of 1998. The Russian President’s apparent unwillingness to get into such a situation again forces him to support the Finance Ministry, even if this leads to increased tax pressure on his favoritism.

...and more robust than the construction lobby

In addition to Gazprom, Vladimir Putin has recently acquired another favorite: The construction complex and its chief lobbyist, Deputy Prime Minister Marat Khusnullin. Putin believes that construction can become the magic wand that will ensure the sustainable growth of the Russian economy. Therefore, the Russian President actively supports many initiatives to implement construction projects financed from the budget and programs to subsidize interest rates on loans that companies receive for their construction initiatives.

Marat Khusnullin is an official who has understood very well what reports the Russian President is expecting from his subordinates: 1) All the set tasks have been completed, 2) There are specific and calculated proposals for new global projects, 3) These projects have been discussed (but not agreed upon) with the Ministry of Finance, 4) The existing difficulties can be overcome by applying administrative measures to companies.

All of this could be observed at the Presidium of the State Council meeting, where Vladimir Putin decided to discuss the prospects for housing and infrastructure construction. In Khusnullin’s speech, one could find “one million additional jobs,” “one trillion additional taxes,” and “one billion square meters of housing.” The volume of total investment in projects voiced by the Deputy Prime Minister is an estimated 160 trillion rubles (125% of GDP-2021) by 2030; the federal budget should finance 20% of this amount.

The ambitious plans of the construction lobby did not please Finance Minister Anton Siluanov, who, for 10 minutes, methodically and in detail explained to Putin why the requested funds from the budget could not be allocated. Siluanov’s position was supported by Elvira Nabiullina, Chairman of the Bank of Russia, who put all of Putin’s criticisms into two sentences:

It has been suggested to fix the expenditures for different purposes in the draft instructions already. It seems that it would have been better to do it later, when the whole structure of the budget and all expenses are clear, to maintain macroeconomic stability.

This was enough for Vladimir Putin not to come to any conclusions or decisions, confining himself to the phrase, “There are so many issues here... we’ll have to elaborate on the Presidential orders.”

New gas attack

After the missile attack on gas rigs in the Black Sea, Ukraine keeps attacking Russia on the “gas front.” Naftogaz plans to initiate arbitrage proceedings against Gazprom concerning the gas transit contract. The Ukrainian company is not satisfied that “Gazprom” has not fully fulfilled its obligations under the contract 2019 on the contract capacity of Ukrainian gas pipelines. In addition, “Naftogaz” is ready to renew its claim against “Gazprom” for $12 billion, which “Naftogaz” has committed to terminate as part of the agreements from the end of 2019. The essence of the lawsuit was that Gazprom must pay for the reduction in the cost of the Ukrainian gas transportation system, caused by the fact that the Russian company has drastically reduced the use of its capacity from 2009-2019 and announced its intention to abandon the Ukrainian transit route completely.

Under the 2019 contract, Gazprom has booked 40 billion cubic meters (109 million cubic meters per day) of capacity in Ukrainian pipelines from 2021 to 2024 on a ship-or-pay (pump-or-pay) basis. Gas is delivered to two receiving points on the border between Russia and Ukraine—Sudzha and Sokhranovka; however, on May 11, Naftogaz suspended gas reception in Sokhranovka, which accounts for about a third of transit supplies through Ukraine (up to 32.6 million cubic meters per day). The company explained this by its losing control over its first compressor station after seizing part of Ukraine’s territory and being unable to control the volume of gas. In this situation, Naftogaz offered Gazprom to direct the entire gas flow to Sudzha, but the Russian company stated that it was technically impossible. As a result, since May 11, gas transit through Ukraine has dropped by about 60%, so Gazprom cut its payment for May. Naftogaz considered it a contract violation and filed a claim against Gazprom. According to the terms of the contract, in case of disputes, the companies have 45 days to settle them. If this does not happen, then the parties can go to arbitration. The 45-day period expires in mid-July.

The new weapons “are not”

A year ago, in May 2021, Russian Defense Minister Sergei Shoigu said that the operation in Syria presented “unpleasant surprises” because the Russian weapons that have undergone state testing and been accepted for service “are not inherently such.” He said that almost a dozen-and-a-half weaponry samples were taken out of service, specifying that this applied to communication, electronic warfare, reconnaissance, and strike systems. Similar problems began to arise in the Russian army after the start of the war in Ukraine.

For example, the Russian Navy refused to extend the contract to produce Project 22160 patrol ships (corvettes) because their tactical and technical characteristics did not match the combat conditions of application. The last ships of the series ordered in 2014-2015 will be handed over to the Black Sea Fleet by the end of next year, and no new ones will be requested. It turned out that sailors were not satisfied with the characteristics and equipment of the corvettes, which were exposed during their combat use. It was revealed that the corvettes had insufficient seaworthiness; they had too-light armor, vulnerable propulsion systems, and poor air defense (photos of these corvettes with a short-range surface-to-air missile system, Tor, placed on the helicopter pad appeared after the war began).

Experts assert that the deficiencies of the corvettes were evident at the stage of their construction. Still, the Defense Ministry refused to discuss the project’s refinement and extend the contract term. The project was unsuccessful primarily because of the initially flawed concept of “an innovative patrol ship of minimum displacement with modular armament.” Such ships require excellent seaworthiness, and Project 22160 corvettes could not accommodate rock stabilizers due to their small displacement. “Innovative contours” of the corvette proved unsuccessful in hydrodynamics. The Russian cruiser of the early 20th century, Boyarin, with twice the displacement and less power plant capacity, had more speed than the Project 22160 patrol ship.

The decree surprised me

President Putin signed a decree regulating payments on Russian Eurobonds to non-residents, which surprised me in three ways.

First, the decree states that Russia has the right to make coupon and principal payments in rubles. However, this does not mean that Russia refuses to make payments in foreign currency. The decree does not specify who will decide how the government’s obligations will be fulfilled.

Second, the decree stipulates that those payments in rubles will be credited to special accounts while the Bank of Russia has not yet determined its regime. It will be indexed following changes in the dollar exchange rate. Any payment on the Eurobonds for the Ministry of Finance will not be final, and the budget will have to make additional payments from time to time.

Third, the decree establishes that “obligations under Eurobonds of the Russian Federation are recognized as duly discharged” if discharged by the procedure established by the decree. Most of Russia’s Eurobonds are issued under English law, and I doubt that the courts would agree that Vladimir Putin has the right to change their terms, especially since Russian law does not give the President such a right, even concerning contracts under Russian law.

Going away the Swedish way

Sweden’s retailer IKEA was the leader among foreign companies entering the Russian market in the 2000s. It invested hundreds of millions of dollars in shopping and logistics centers, building its first megamall in Moscow in 2002. By the end of 2021, it had opened more than 20 stores in different Russian cities and built four furniture factories. In early March, following the Russian invasion of Ukraine, IKEA announced a temporary sales halt.

Last week, the company said its business and supply chain situation had deteriorated over the past three months and that it saw no way to resume sales in the foreseeable future, so it intended to sell all the factories. This week, the company told mall owners to break their leases, meaning it would stop trading in Russia altogether.

One of the factories is in the city of Tikhvin in the Leningrad region, where 56,000 people live. The head of the town, Alexander Lazarevich, said this would create many problems.

“For us... the main thing is PIT and jobs. People were provided jobs (the factory employed more than 1,050 people), plus about a thousand people worked as contractors who maintained the plant outside the company. They, too, will suffer.”

Lazarevich expects the IKEA factory to be sold quickly, with its profile preserved or repurposed, hoping to save jobs. However, it is impossible to understand who can become a buyer of a highly specialized factory without obtaining the rights to produce IKEA furniture and the right to use the brand.

The city’s problems are aggravated by the its largest enterprise, the carriage factory, which has been idle since May 17 because imports of bearings manufactured in the U.S. have stopped. This plant employs 7,000 people, every fourth working-age resident of the city.

Looks like it!

I am surprised by the transparency with which Russian military has been admitting these problems. I thought Russia would keep these problems to themselves.