March 9, 2022

The siege of Kyiv become real

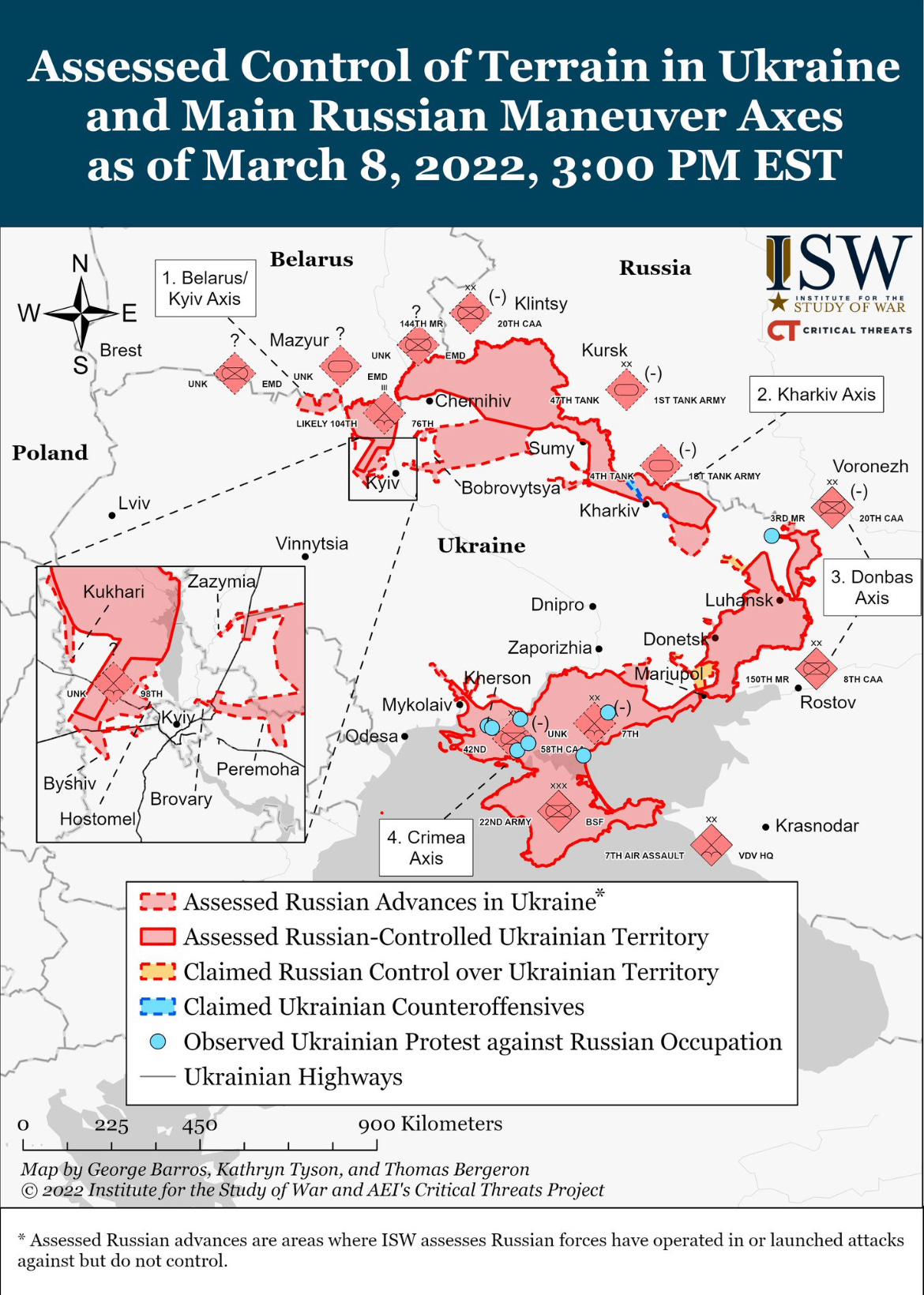

In the past 36 hours, a Russian army group advancing from Belarus has moved significantly toward Kyiv from the north along the right bank of the Dnieper River. There are no major population centers in this direction that would typically deter an offensive; in addition, the Russian military has plotted its route through the unpopulated exclusion zone of the Chernobyl nuclear power plant. This advance by Russian troops makes it realistic to encircle the right-bank part of Kyiv, where all government and historical buildings are located, which will be sandwiched between the river and Russian soldiers.

The president was deceived. Once again

On March 7, Vladimir Putin said no conscripts are among the Russian troops fighting in Ukraine. However, on Wednesday, the Russian Defense Ministry was forced to admit that this was not true—the Ukrainian authorities posted a video in which captive Russian soldiers give the numbers of their military units and state that they are not professionals.

Dmitry Peskov, spokesman for the Russian President, naturally said that Putin had given strict instructions not to involve conscript soldiers but that some generals had failed to follow that order. The Chief Military Prosecutor’s Office is looking for these generals. Most likely, however, the culprits will not be found: The Russian Defense Ministry has reported that these soldiers served in auxiliary units and did not take part in combat operations.

New sanctions

The EU is increasing its pressure on Kremlin and Russian elites. It has included in its sanctions lists a group of executives of major Russian companies that operate in “major sectors of the economy and are a significant source of funds for the Russian Federation,” as well as their family members. Some of them are executives and owners of companies, which could cause severe problems for their exports to EU countries if the sanctions apply to these companies.

For example, Andrey Melnichenko (owner of SUEK, Russia’s largest coal exporter, and Eurochem, a fertilizer producer), Dmitry Pumpyanskiy (TMK, the largest pipe manufacturing company, and industrial holding Sinara), Vadim Moshkovich (agricultural holding Rusagro), and Dmitry Mazepin (Uralchem/Uralkali) have fallen under sanctions, as have Alexander Vinokurov (President of Marathon Group, the largest shareholder of food retailer Magnit, son-in-law of Russian Foreign Minister Sergei Lavrov), Andrey Guryev (head of PhosAgro), Mikhail Poluboyarinov (CEO of Aeroflot), Dmitry Konov (head of SIBUR), Mikhail Oseevsky (CEO of Rostelecom), and Rosnano CEO Sergey Kulikov.

Does it affect the economy?

The long weekend in Russia is over, and information about the effects of economic sanctions on individual industries and companies has increased.

Rosstat published inflation data for the first days after the outbreak of war and the imposition of the first sanctions. From February 26 to March 4, 2022, consumer prices rose by 2.22% (10% per month or 210% p.a.), the highest rate since the start of 1999. The standard measure of hyperinflation is 20% per month.

The Federal State Statistics Service measures weekly inflation in a narrower range of goods, so a month’s figures may differ from a week’s.

The most significant growth in prices was seen in tourist trips abroad (28.7%), domestic and imported cars (17% and 15%, respectively), consumer electronics (10% to 14%), and medicines (2.7% to 6.1%). Sugar (3.3%) and canned vegetables for children (2.4%) went up the most among foodstuffs.

The ban imposed by the Bank of Russia on banks selling cash currency to the population and restrictions on withdrawal of cash currency from bank deposits were the most puzzling measures taken by the Russian government. Russian commercial banks will be beneficiaries of the introduced order, which, however, have not stopped selling currency to the population as was required by the Bank of Russia. Moreover, the end of the weekend led to a reduction of the gap between the buying and selling rates from 20%-30% to 15%-20%.

The Moscow Stock Exchange resumed currency trading; the dollar exchange rate gradually increased during the day. By the end of trading, it reached 120 rubles per dollar (+13% compared to the previous day). Judging by the intraday dynamics of the exchange rate, the Bank of Russia strictly controls the admission of participants to the market until the end of its working day. In contrast to previous days, the official dollar exchange rate set by the Bank of Russia does not differ much from the exchange rate (116 rubles/$). Still, it varies significantly from the interbank market rate (137 rubles/$).

Although the sanctions imposed on Russia by the EU and the U.S. have not affected the pharmaceutical industry, Russian companies may be left without imported raw materials and components. According to industry experts, about 80%-85% of Russian drugs are made from imported substances. In 2021, 76.7% of raw materials imported to Russia came from India and China, 19.7% from the European Union.

Over the past 10 days, imported substances have increased by 30%-35% in Russia. European companies have almost stopped supplying substances. Their import from China and India, which accounts for nearly 80% of the total volume of imported raw materials, is hampered by seriously disrupted logistics chains. According to various estimates, companies have three to six months of stock left.

At a meeting with representatives of the biggest banks, Bank of Russia executives said they had no plans yet to resume trading on the stock section of the Moscow Exchange. This means that the assets of Russian and foreign investors will remain frozen.

Fighting with consequences not causes

The Russian authorities are seriously concerned about the mass stopping of companies owned by foreign investors. Formally, the government has not supported the initiative to nationalize them, but it intends to carry it out using the mechanism of external management laid down in the bankruptcy law.

Alexander Zhukov, First Deputy Chairman of the State Duma, described the preparation of a law that would allow board members of such companies, regional governors, prosecutors, or tax authorities to apply to a court for the appointment of external administration.

“Interim measures in the form of a ban on disposal of property, dismissal of employees, termination of certain contracts, disposal of the share capital may be imposed on a company from the date the court accepts the application,” Zhukov said.

After International Payment Systems (IPS) announced the suspension of their activities in Russia, banks began to extend the validity of already-issued cards indefinitely. Thus, Sovcombank (under U.S. and EU sanctions) intends to open them until 2028, Rosbank (a subsidiary of French Société Générale) and Moscow Credit Bank—until 2030, while Gazprombank, VTB, and Tinkoff have announced that they are making their cards perpetual.

The move is prompted by anticipated problems with the supply of bank card chips to Russia: Suppliers are hesitant to sell chips to Russia, and banks are having problems paying for supplies and delivering chips to Russia. Technically, cards “in plastic” can work for quite a long time, up to 10 years, and Russian banks quite rationally decided to wait before making radical decisions.

According to analysts, there are almost 1,000 aircraft in operation in Russia today, three-quarters of which are foreign-made. There is no detailed description of the restrictions imposed by the European Union and Great Britain on aircraft leasing, and Russian lawyers proceed from a conservative scenario. All leasing contracts must be closed by March 28. The government will help Russian airlines retain a fleet of foreign aircraft amid sanctions, Prime Minister Mikhail Mishustin has said. The government will consider a draft law that provides for “simplification of procedures for certification and admission of aircraft to operation” and “establishment of accreditation procedure for certification testing laboratories, systematization of requirements in the field of airworthiness rationing.” This approach envisages that aircraft will not be returned to lessors and will remain in Russia.

These proposals have provoked strong opposition from airlines, who point out (without considering the risk of sanctions against airlines that will be responsible for the seizure of aircraft) that the lack of software updates and designer oversight of maintenance and repair work could severely impact flight safety. However, representatives of airlines refuse to openly object to the documents prepared by the Ministry of Transport, fearing negative consequences.

Experts believe that the Russian planes may also have maintenance problems: The SSJ 100 (the airlines have 130-140 aircraft) are equipped with Sam146 engines manufactured by a joint venture between Snecma of France and NPO Saturn Russia using components made by French, Italian, and Spanish companies. So far, the French company has not declared the suspension of its activities in Russia, but nobody excludes this scenario.

At a meeting with representatives of major banks, Bank of Russia officials said they had no plans yet to resume trading on the stock section of the Moscow bourse. This means that the assets of Russian and foreign investors will remain frozen.