October 5, 2022

Nuclear terrorism

Is war a war?

Not sure of success

Half influencing

Not V-shape. Maybe L?

Oil industry is in a good shape

One step back

Lucrative port

Just a fact

Nuclear terrorism

Vladimir Putin signed a decree imposing Russian technical and managerial control over Zaporizhya Nuclear Power Plant. It is the first case in history when one country seizes the nuclear object of another.

Is war a war?

Vladimir Putin signed laws annexing Ukraine’s occupied regions, which, according to the signed documents, have been an integral part of Russia for the Russian authorities since September 30.

However, the real force of these documents is not apparent even to the Kremlin. In the past five days since September 30, the Ukrainian army has conducted several offensive operations and liberated over 1,200 square kilometers of their country’s territory, and another 600 square kilometers are in “neutral” status, in which neither of the warring parties can claim that they are confidently in control of this territory. It turns out (if we take the Kremlin’s position) that the Ukrainian army has attacked Russia and is taking away part of its territory, but this does not cause changes in the rhetoric and actions of the Russian leadership—it is still an extraordinary military operation, the status of which is not defined by law in any way.

Not sure of success

Although most Russians still support the war in Ukraine, there is a growing awareness in the public consciousness that not everything is going according to plan. A poll by the Levada-Center showed that in September, the proportion of those who believe that the military operation is not going well increased by half compared to April-May, while the proportion of those who are firmly convinced of this has doubled.

Although the percentage of respondents who believe that the military operation is going on successfully remains above 50%, the share of those who are firmly convinced of this has dropped below 10% (17%-18% in April-May).

Not V-shape. Maybe L?

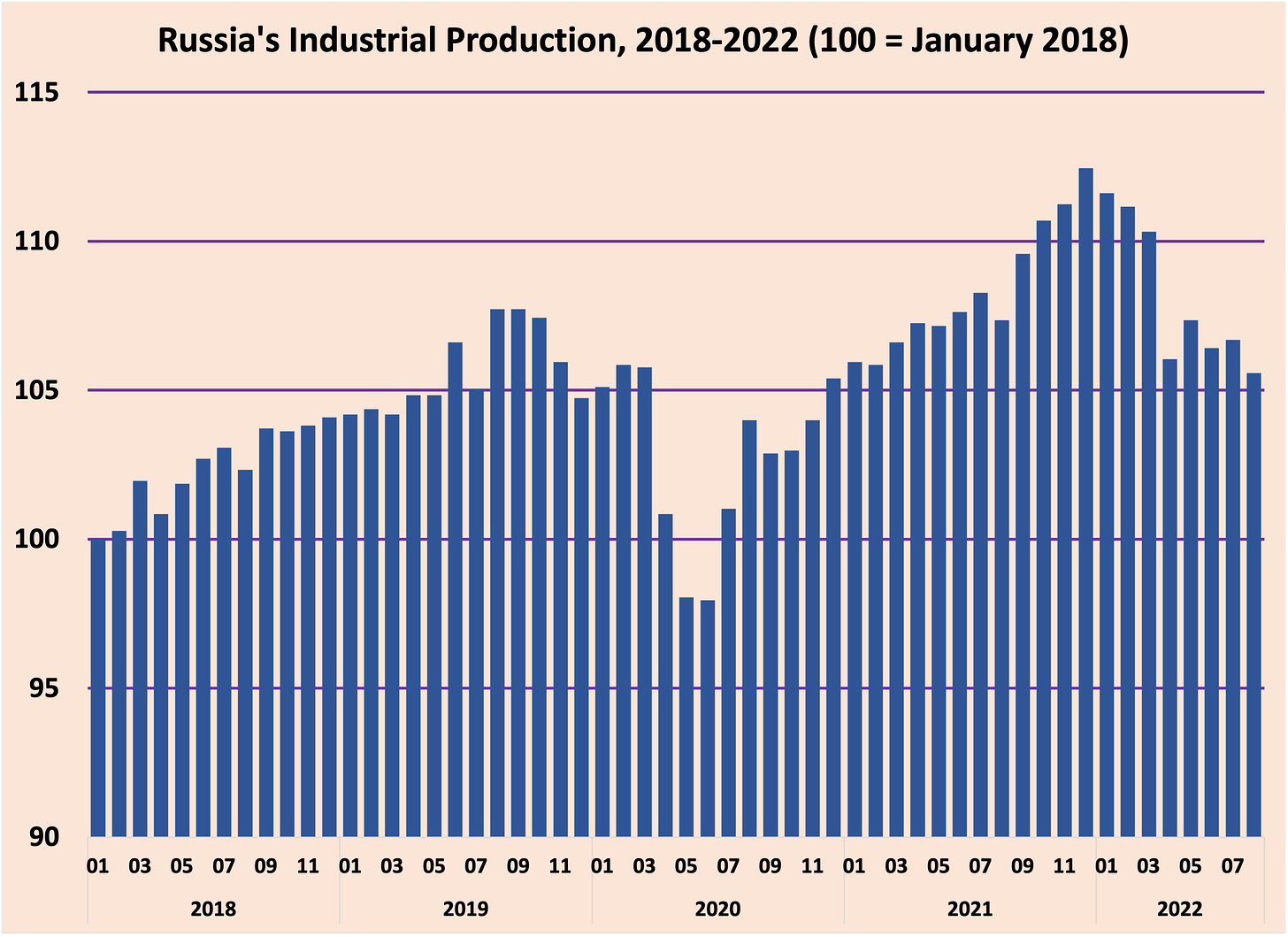

The Development Center published its evaluation of the dynamics of industrial production for the first eight months of this year.

The center’s experts say that the decline in Russian industrial dynamics in the spring of 2022 because of sanctions imposed by Western countries overlapped with the phase of intensive economic recovery after the coronavirus crisis that lasted a year and a half, from mid-2020 to the end of 2021. Under the influence of sanctions, Russian industry plummeted in April—the intensity of the decline, the center estimates, was similar to that seen in spring 2020 when restrictions on economic activity related to the coronavirus pandemic were introduced. The center’s experts argue that the dynamics of Russian industry suggest that the current crisis is developing along the L-trajectory, and there is no reason yet to say that the industry is ready to begin a rapid recovery (V-trajectory), as it did two years ago.

Development Center experts say that the decline phase in Russian industry was short and limited to April, after which stagnation began. In my opinion, this forecast is overly optimistic and does not consider the possible impact of the announced sanctions, which have not yet entered into force, as well as the decline in production, which will be caused by the gradual depletion of stocks of imported components, the supply of which has stopped.

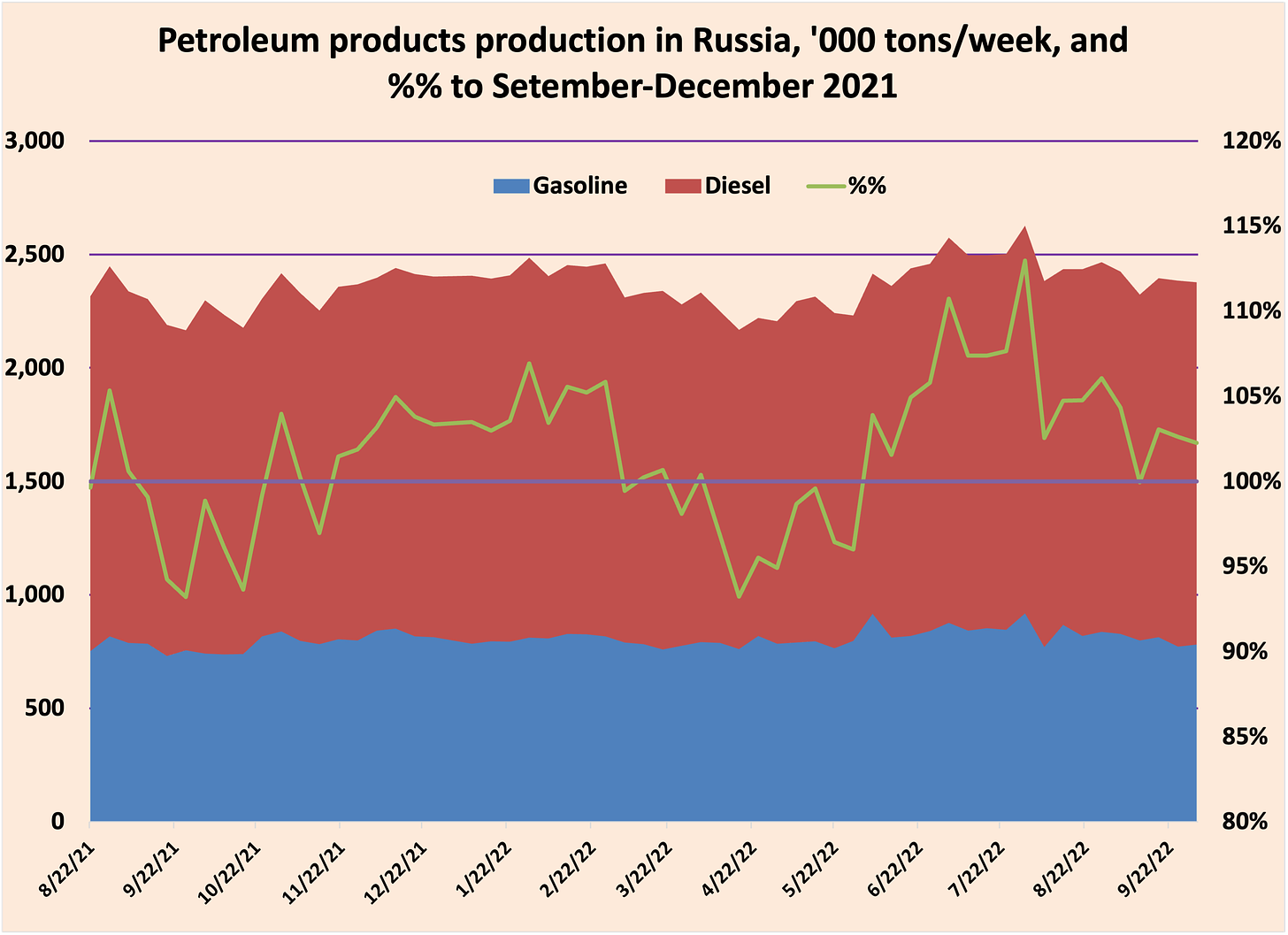

According to the operative information, after the decrease in August-September, oil production in Russia grew by 1%: By the third quarter, it had made about 400 million tons, having increased by 3% as compared with the previous year. Experts expect that by the end of the year, the oil production in the Russian Federation will decrease by no more than 1%.

The main reasons for the decrease in production in August were not the impact of the Western sanctions but the reduction in the production of gas condensate (included in the Russian statistics in the volume of oil produced) and the cessation of production at the Prirazlomnoye field of Gazprom Neft due to repairs.

Oil industry is in a good shape

Although there was a seasonal decrease in demand for petroleum products in Russia in September, the volume of oil refining remained at a stable high level, which indicates that Russian companies were able to find consumers of their products outside Russia.

Currently, Russia’s oil production, together with condensate, is at 10.7 million bpd. Without condensate, it is about 10 million bpd, which is about 1 million bpd less than the current quota under the OPEC+ deal. As OPEC+ agreed to cut production by 2 million bpd, Russia’s quota could be reduced by 600,000 bpd. Not only would such a “reduction” not force Russia to limit its oil production, but, on the contrary, it would leave room for further increases.

One step back

“Gazprom” has decided to somewhat reduce the tension on the “European front” and signed the necessary documents with the Austrian company to pump gas. In unofficial comments, representatives of the Russian company said that the delay in signing the papers was because Gazprom could not guarantee the passage of payments for gas transit services amid sanctions restrictions. The company did not explain what conditions prevented payments from being made or how they were overcome, saying it did so with the help of Italy’s Eni company, a buyer of gas going through Austria.

Lucrative port

The Russian authorities are continuing their creeping nationalization. This time, the Kremlin took a fancy to the Murmansk Sea Fishing Port, privatized not in the “wild ’90s” but in the quieter times of 2015.

The Russian Antimonopoly Service (FAS) filed a lawsuit to seize 100% of the shares of this company in favor of the state, and after some deliberation, the court granted the claim.

The court’s decision explained that two businessmen, who became the port owners in 2015, decided to reconsider their relationship, and one obtained control of 100% of the shares. To get the deal out from under the watchful eye of the IRS, it was structured using offshore companies that acted as transit intermediaries. And this circumstance—the purchase of shares in a “strategic enterprise” for a short time by a non-resident without the government’s permission—was used in court to recognize the transaction as null and void.

If I had been the judge, my focus would have been tax evasion; the fact that there was no government permission for transactions between Russian residents is certainly not good, but deprivation of property is hardly an adequate punishment. But in considering this case, I would not take into account the fact that the port has an oil terminal, which is a steady source of income, that a new terminal will be built at the pier to export Belarusian fertilizers, and that the port of Murmansk is a deepwater and ice-free port, which, according to the FAS, has strategic importance “to ensure the defense and security of the country.”

That’s probably why I can’t be a Russian judge.

Just a fact

The Russian Ministry of Finance reported that the average price of Russian oil exports in September was $68.25/bbl, 24% lower than the Brent price. The price cap on Russian oil, imposed by China and India, works perfectly.

Half influencing

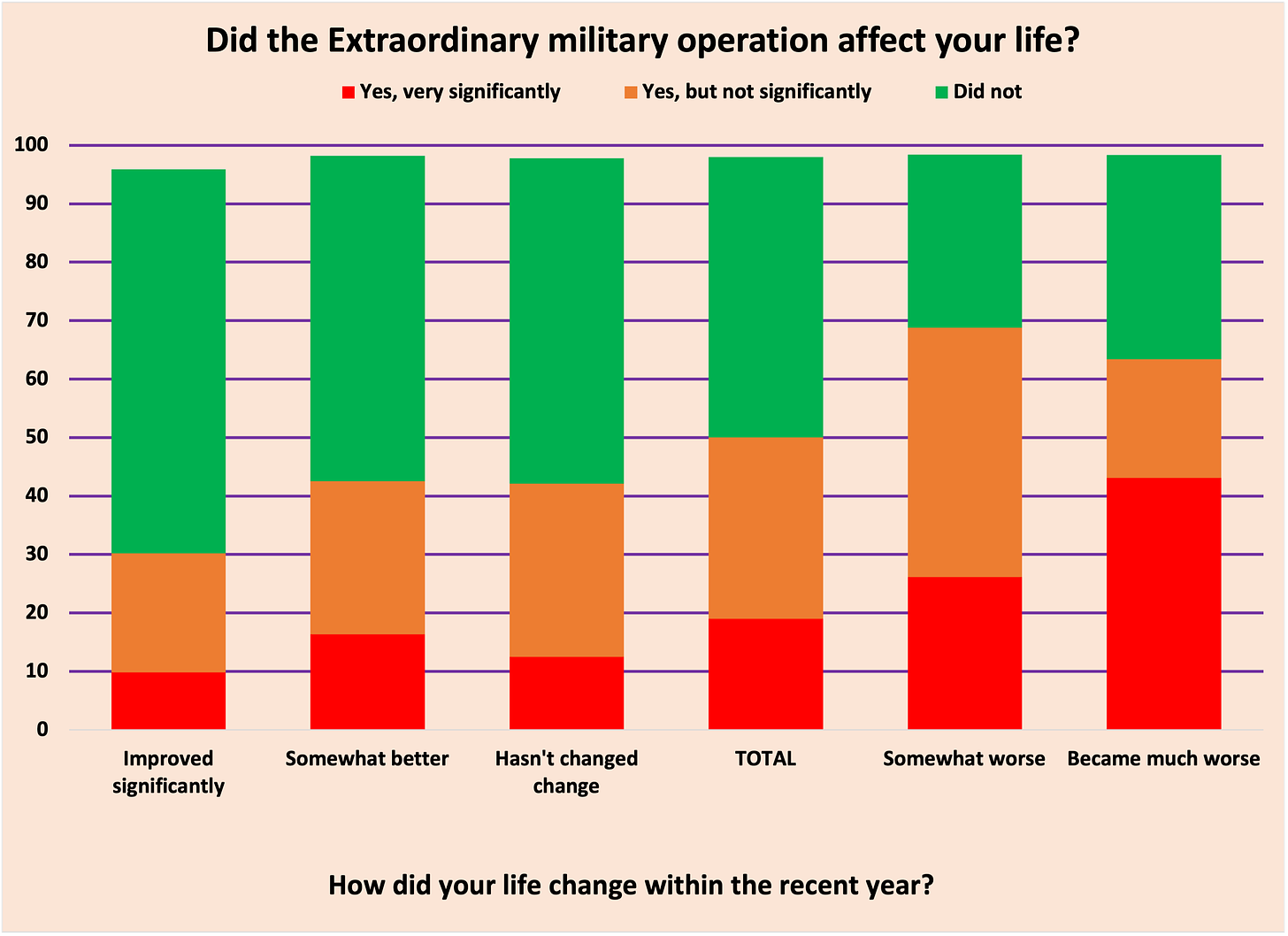

According to the Levada-Center poll, half of Russians believe that the war in Ukraine has affected their lives,

including one in five (19%) who said it had a strong impact. The other half (48%) did not notice any such influence.

I have already noted that the main channel of influence on the opinions of Russians is changes in the standard of living, and this survey confirmed that once again. Forty-three percent of respondents who reported a deterioration in their quality of life over the past year noted the strong influence of the war in Ukraine. The same 43% of respondents who said that life has become “somewhat worse” stated the moderate impact of the war. At the same time, 56% of those whose “life has not changed” or whose life has become “somewhat better” said that the war has not affected them in any way.