September 22, 2022

A coercive draft is normal

Should we find out?

Problems are not serious

Implementing the president’s dream

To be nationalized

There are no ex-prime ministers

Liberals?!

A coercive draft is normal

The website OVD-Info reported at least 1,386 people were detained during yesterday’s anti-war protests in 38 Russian cities. There is no generalized data yet on how the Russian authorities will punish the protesters, but one form of punishment is already known. Many of those detained at police stations received summons to report to the military registration and enlistment office regarding the decision to mobilize.

According to Dmitry Peskov, the Russian President’s Press Secretary, serving summonses to detainees does not contradict the law:

There is no violation of any rights.

It is expected that many of the detainees will be ordered to go to the army.

Should we find out?

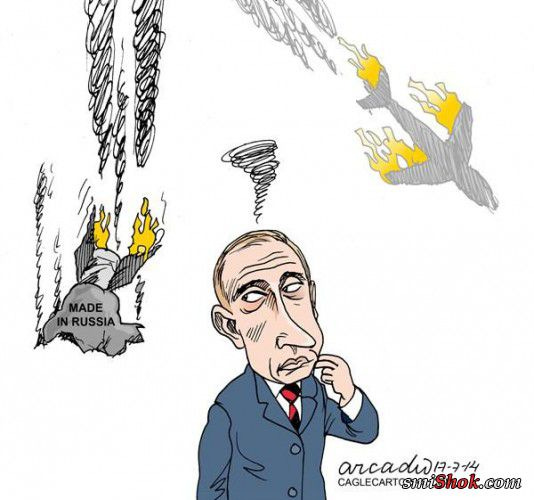

The District Court in The Hague announced the completion of hearings in the case of the crash of Malaysia Airlines Boeing 777 passenger flight MH17 in July 2014 over Donbas. The court plans to announce its decision on November 17, Judge Hendrick Steinhaus said. However, it remains possible that the date of announcing the decision may be postponed if new circumstances emerge in the case.

The Joint Investigative Team (JIT) probed the crash and reported its preliminary findings to the court six years ago, in September 2016. According to the investigation, the plane was shot down by a Buk 9M38 surface-to-air missile fired from a field near the village of Pervomayskoye, which at the time of the crash was controlled by pro-Russian armed militants.

Parallel to the JIT’s investigation of the circumstances of the crash, independent experts studied the crash and presented numerous pieces of evidence that confirmed the correctness of the investigators’ conclusions. I do not doubt that the court will convict the four Russian fighters in Russia, but the main question that remains for the court to answer is: Who decided to hand over the advanced missile systems to the fighters?

Problems are not serious

Russian coal exports to India may fall by 30% in September, according to Indian observers, due to logistical problems. On the one hand, because of the “gas war” launched by the Kremlin against Europe in the Danish straits in the Baltic Sea, the number of ships carrying LNG, oil, and petroleum products has significantly increased, which has extended the waiting period for vessels carrying Russian coal from the port of Ust-Luga near St. Petersburg. On the other hand, at the end of August, the European Commission announced a ban on providing insurance services for Russian coal shipments, which sharply reduced freight availability for Russian coal miners. According to Denis Rakhimzhanov, Director of Logistics for Russia’s largest coal company SUEK, Russian coal companies have access to only 30% of global bulk freight.

Back in February, we had 100% available to us; today, we have only 30% available, and, in addition, in August, we faced unprecedented influence of the clubs which provide reinsurance of ships.

According to Indian customs, Russia increased coal supplies to this country in January-July by 2.5 times compared to last year. Russian companies do not consider the problems insurmountable and are confident that

India’s coal exports will grow: Coal accounts for over 70% of the country’s total energy mix; Russia’s share in India’s imports is only 4% and will grow, considering the high quality of Russian coal and the willingness of companies to give substantial discounts on the current world prices.

Implementing the president’s dream

Russian Railways (RZD) has enthusiastically joined the race to increase investment, which, according to Vladimir Putin’s plan, should ensure the growth of the Russian economy.

The company submitted the proposal to the government to increase the investment program for the next three years: In 2021, it amounted to 703 billion rubles; this year it is planned at 761 billion rubles; in 2023, it will grow to 1.23 trillion rubles; and in 2025 it will amount to 1.66 trillion rubles. RZD supposes to finance the investments at the expense of the tariffs indexation, which will go way ahead of the planned inflation rate within the next two years: 9.8% in 2023 and 9.1% in 2024. The Ministry of Economy stands in the way of RZD, which does not agree to index it more than 7.7% and 7%, respectively.

An essential element of the budget concept of RZD was the proposal to cancel the discount on the coal transportation tariffs for the next three years. The company refers to the position of the President, who approved the expansion of the application of the ship-or-pay principle (payment by coal miners of the guaranteed transportation volume regardless of the actual situation). If the government supports this proposal, coal companies will be faced with the choice of closing unprofitable mines or investing in coal beneficiation to increase their export price. After introducing the European Union ban on imports of Russian coal, investments in the industry have stopped, as companies urgently need to find new markets. And, of course, they did not expect such a “stab in the back” from Russian Railways.

There are no ex-prime ministers

Having heard about the plans of the Russian government to allocate extensive budgetary funding for programs to create the electronics industry, brotherly Belarus decided to try and “nibble a piece of the pie.”

Chairman of the EEC Board of the Eurasian Economic Union, former Prime Minister of Belarus Mikhail Myasnikovich, suggested developing an interstate program of semiconductor industry development in the EEU member states (Russia, Belarus, Armenia, Kazakhstan, and Kyrgyzstan). The former Belarusian Prime Minister proposes to take as an example the programs approved in the European Union and the U.S., which have announced plans to invest €43 billion and $52 billion, respectively, into the semiconductor industry.

“It is expedient to position the development of a semiconductor sphere as one of the projects—symbols of Eurasian integration.”

Experts are skeptical about these ideas: The current technological level of the Belarusian electronics industry is lower than in Russia; other EurAsEC countries have virtually no such industry. According to Myasnikovich’s idea, Belarus and other partners of Russia in the economic union may become a “window of access” to modern Western technologies, the export of which to Russia is currently prohibited.

I see another aspect in the proposal of the former Belarusian Prime Minister: The Belarusian economy cannot maintain a balance without constant financial support from Russia, and Alexander Lukashenko keeps coming up with new justifications for receiving tranches of financial aid from Moscow. The electronics development program could at least partially solve this problem, even if it is not very large-scale. And if electronics do not appear in the Eurasian Union, it will be the fault of the West, which by unfair means limits competition and prevents Russia from access to its markets.

To be nationalized

Mikhail Sukhov, CEO of the Russian rating agency ACRA, which was created with the resources of the Bank of Russia, has worked at the Bank of Russia for 20 years, having been Deputy Chairman in charge of banking supervision for five years (2012-2016). In his interview, he shared his forecast for the development of the Russian banking sector.

The main economic factors, which influence the reduction in the number of banks, have not yet fully unfolded: This is the departure of non-residents and the consolidation of the sector. About a dozen banks would leave the market by the end of the year if the supervisory practices are restored, and another 30-40 players would leave by the end of the following year. It is difficult to forecast such stories, but I believe that within the next year and a half, 50 banks will leave the market due to various objective reasons. The number of credit institutions in the country could come close to 300.

Russian banks will not need capital injections in 2022, in my opinion. However, other instruments can be considered as additional capitalization. For example, it is recommended to the largest banks not to pay dividends in 2022, given the high profits of 2021... In addition, providing funds to the bank for development—for example, to support particular groups of entrepreneurs—can be considered capital support.

Several [regulatory] relaxations related to the revaluation of currency operations [in banks’ balance sheets] and other technical issues can be removed as early as 2023. But it should bear in mind that many banks have assets worth hundreds of billions, frozen or operations that are impossible. In this part, I don’t expect the Central Bank to rush in and require banks to recognize losses in the next five to 10 years.

... By [the beginning of] 2022, the five largest credit institutions held 64% of the banking sector; by the end of next year, the top five will already have 70% of assets. This process is facilitated by the accession of Otkritie to VTB, which may occur before the end of the year, and the departure of non-residents.

The probability [that Unicredit, Raiffeisenbank, and Citibank, the three largest foreign-controlled banks No 10, 12, and 20, which account for 6% of assets in the Russian banking system] will leave Russia is relatively high. The exit form will be determined based on the most effective solution for each bank. If a bank decides and starts the liquidation process this year, by the end of 2023, this work will be completed.

By early 2022, the Russian government was directly or indirectly a controlling shareholder in the banks that controlled 75% of the banking system’s assets. Twelve percent of total banking assets belonged to banks owned by non-residents. If Mikhail Sukhov’s forecast regarding the continued concentration of the banking business comes true, it should not be a surprise that in three to four years, the share of the government in the banking system will reach 90%.

Liberals?!

Deputy Minister of Finance of Russia Alexey Moiseyev said that the Ministry of Finance and the Central Bank have generally agreed on a bill that allows cross-border payments in cryptocurrency.

Now we have a draft law in general, which has already been agreed upon with the Central Bank in this part... It generally describes how to purchase cryptocurrency, what you can do with it, and how you can or cannot pay with it in the first place for cross-border settlements.

That said, it should be recalled that two weeks ago Moiseyev confirmed the government’s position that under the bill, Russians will only be able to create cryptowallets at Russian financial institutions.

Now people open cryptowallets outside the Russian Federation. It should be possible to do it in Russia, so that it could be done by subjects supervised by the Central Bank.