Don’t know what to do? Ask for money!

Everything can change

Talent blossoms

Any new idea is as well a forgotten old one

Volunteer recruitment plan

The plan will not be met

More Oil, Less Gas

Whiskey disappears

Don’t know what to do? Ask for money!

Vladimir Putin held a meeting on the development of the metallurgical complex that was attended by government members and the heads of major steel companies. The first sanctions imposed on Russia after the invasion of Ukraine showed that ferrous metallurgy would be one of the industries that would suffer the most from sanctions. The reason for this is well known: There is significant excess steel production capacity globally, and companies can quickly compensate for the decline in exports of Russian products from other countries.

The impact of sanctions on Russian metallurgy was the central topic of Deputy Prime Minister Denis Manturov’s speech at the meeting. Although the Russian President emphasized in his opening remarks that he intended to discuss the industry’s development strategy extending until 2030 (which he ordered to be developed in April), Manturov gave little time to this topic. According to the Deputy Prime Minister,

Exports of metals in the second quarter decreased by about 20%... there was a significant decrease in domestic consumption... the capacity utilization of the industry declined from an average of 93% to 80%... Magnitogorsk [Magnitogorsk Iron and Steel Works], with a utilization rate of 62%, and Severstal, 72%. They produce predominantly flat steel... [where] there is the most significant compression in demand. Semi-finished steel products partly help the industry: Europe cannot refuse our supplies, and China increased its purchases more than fivefold in the year’s first half.

The set of suggestions that could ease the situation in the industry in the short term, voiced by Manturov, was brief and expected: Lower taxes and purchase of metals in the state reserve. The first seems entirely rational: In mid-2021, after seeing the rapid growth of steel companies’ profits due to rising world prices, the Ministry of Finance decided it was entitled to receive a portion of the excess profits (profit tax in Russia goes to the regional budgets). As a matter of urgency, this idea was coordinated with Vladimir Putin and took the form of a law. Because Russia is allowed to increase taxes only on January 1, steel producers began to pay extra taxes only in January 2022, when world prices began to decline rapidly, and the excess profits disappeared.

As for the purchase of metals in the state reserve, this idea has one undoubted advantage: Its implementation does not require anything but the allocation of budget funds. However, on the whole, this idea looks more than dubious. First, in defense of the concept, the Deputy Prime Minister referred to “the current conditions of low prices,” even though current steel prices are much higher than they have been for the past 10 years. Second, he did not offer any concept of reserves management, limiting himself to the statement that the metal reserves “can be used for intervention in the domestic market when prices rise, and also in case of a shortage of products of metallurgical plants in Donbas to restore the infrastructure of the region.”

Denis Manturov did not have many strategic ideas either, and they all implied the allocation of budget money for implementing a program to modernize the housing and utilities sector and build highways and oil and gas pipelines “in the direction of the Asia-Pacific region in the first place.” The only proposal, the implementation of which implied private business initiative, was the idea of “stimulating the construction of modular housing on a metal frame.” In his speech, the Deputy Prime Minister promised that by 2030 this technology would be used in the construction of up to 30% of mass housing.

Everything can change

A month ago, Putin signed a decree nationalizing Shell (27.5% minus one share), Mitsui (12.5%), and Mitsubishi (10%) interests in Sakhalin-II1. This company is engaged in gas and LNG production, and export of liquefied gas on the Sakhalin shelf. It sells 9.5-10 mln t of LNG annually (15% of Russian LNG exports and about 2.5% of the world market). At the end of last week, the company sent a letter to buyers of its products demanding that they make payments through a Russian bank, Gazprombank, leaving other contracts unchanged (payment currency, volumes, prices, and delivery locations).

Gazprom’s concerns—the risk of freezing funds in the bank accounts—are understandable; at the same time, so long as the Kremlin does not demand to convert payments for LNG into rubles, as was done for pipeline gas in Europe, the LNG market is competitive. The demand to change the currency of settlement may lead to the loss of sales markets and the need to provide discounts to new customers who agree to pay for LNG in rubles.

Talent blossoms

Recently I told you about the business talents of Andrei Patrushev (Two brothers, two fates), son of the Secretary of the Russian Security Council—he managed to buy a stake in a company that is, in fact, a monopolist in drilling services for NOVATEK. This Russian company produces 91% of Russia’s LNG (incl.Yamal LNG, in which NOVATEK owns 50/1%). But a short time later, it turned out to have been a prelude.

The company changed its name, “Aurora,” to the much-more-euphonious “Gazprom shelfproekt” and put the Gazprom logo on its corporate letterheads. After the rebranding, the company of Patrushev Junior got the fleet of floating drilling platforms and supply vessels of Gazprom Flot and intends to consolidate all orders of Gazprom and NOVATEK for drilling in the Arctic seas.

Any new idea is as well a forgotten old one

The Kremlin is stepping up its propaganda machine, targeting schoolchildren and youth. Starting in September, all Russian schools will have “Conversations about Important Things” classes to discuss the values of Russian society enshrined in the national security strategy, said Sergei Novikov, head of the Presidential Directorate for Social Projects.

According to him, these class hours may be held in different forms; it will depend on the age of the schoolchildren. “Because different age groups need different forms [of classroom hours], it could be a discussion based on the results of a movie watched, a quiz, methodological material in the form of a full lesson, communication with an expert on the topic of a particular class hour, which can also be broadcast to the whole country, because now the distance communication system allows doing this.”

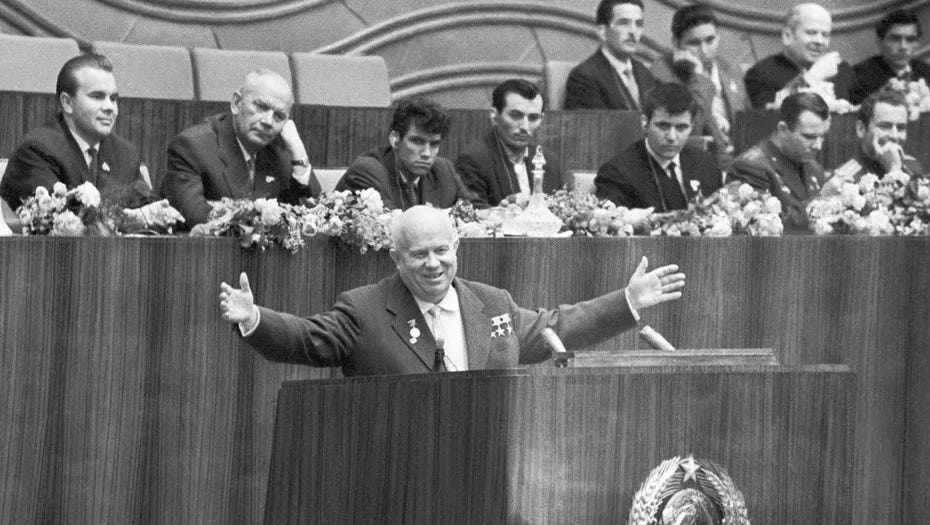

The exact words can be used to describe the goals of the Soviet ideological machine, which brainwashed the population for 75 years. The ideological workers of the time seemed very successful in teaching the norms of the “Moral Code of the Builder of Communism” - incorporated into the Communist Party Charter in 1961 when Nikita Khruschev promised to build communism in the USSR by 1980 - to the younger generation, which did not save the Soviet Union and its ideology from collapse in the early 1990s.

Volunteer recruitment plan

The Russian army continues to experience a shortage of personnel for the continuation of the war with Ukraine, and the Kremlin is beginning to use the principles of conscription, issuing assignments to regional authorities to bring in contract volunteers.

Tayga.info published a letter from the Oktyabrsky District of Novosibirsk administration, which was sent to the heads of enterprises, with requests to organize meetings between the teams and military commissars.

The administration of the Oktyabrsky District received a letter from the Military Commissar of the Oktyabrsky District and the Central District of Novosibirsk S. Kharlamov dated July 11, 2022, with the notice that the decision of the Governor of the Novosibirsk region [Andrei Travnikov] determined the task to form named reserve battalions to perform the tasks of the special operation. According to the assignment, the Oktyabrsky District is charged with recruiting 37 people from citizens in the reserve of the Armed Forces of the Russian Federation.

Earlier, the administration of Novosibirsk’s Central District asked company leaders to “consider assisting servicemen” of the 41st Army “performing a special operation in Ukraine, Luhansk, and Donetsk regions.” In this case, the administration referred to the appeal of the army commander, who told the Mayor that the soldiers needed 5,000 pairs of socks, 2,000 shirts and underpants, 1,000 packs of paper tissues and wet toilet paper, as well as 1,000 handkerchiefs, soap, and water. The Russian army also needed tea, coffee, cookies, wafers, candy, matches, cigarettes, and mosquito repellent. Judging by this request, the Russian Ministry of Defense did not receive money from the Ministry of Finance to supply overpaid contract soldiers with necessities.

The plan will not be met

The Rosseti company (Russian grid company, owner of national grids and controlling shareholder of regional grids), 88% of whose shares are owned by the state, is failing to meet the deadline for the construction of the electric grid infrastructure of the railroads, without which it is impossible to increase the transportation of cargoes through the Pacific ports (the so-called Eastern Polygon). The reasons for the failure to meet the construction deadline are well understood—the refusal of companies from “unfriendly” countries to supply equipment.

Vladimir Putin decided to change the completion date personally, and the company management informed him of their problems. In principle, this should come as no surprise. Over the past year, Putin has held three significant meetings to discuss plans for increasing the capacity of the Eastern Polygon, personally defining the objectives and appointing those in charge. The program established by the President for 2022 provides for the transportation of 144 million tons of cargo, and in 2024 it must increase to 180 million tons. The urgency of this task increased sharply after the invasion of Ukraine by the Russian army and the EU embargo on imports of Russian coal, steel, timber, and fertilizers. After that, competition among Russian companies for access to the capacity of the Eastern range increased sharply, particularly to the displacement of coal exports, the transportation of which did not bring profits to the railroads.

Putin agreed to the proposal to postpone the completion of the energy infrastructure for nine months, expecting that Rosseti would be able to find analogs of the unreceived equipment in Russia and “friendly” countries during this time.

More Oil, Less Gas

Russia’s average daily oil production rose 2% in July compared to June, to 1.468 million tons (10.76 million barrels), which remains 2.7% lower than in February. The increase in oil production did not translate into an increase in exports, which fell 1.4% in June compared to June. All of the extra oil went to refineries and was exported as petroleum products, which increased by 4%. Because the embargo on imports of oil products from Russia to EU countries was postponed until February, their sales did not cause problems.

Total oil production in Russia since the beginning of the year was 308.7 million tons (10.67 mbd), which is 3.2% more than last year.

The “energy war” with the countries of the European Union is not without consequences for Gazprom: In the seven months of this year, its gas production was reduced by 12% to 262.4 billion cubic meters, and exports to European countries fell by almost 35%. Gazprom’s attempt to make up for that information with something good—gas exports to China are up 63% YoY. Experts are unlikely to be very happy about that: Last year, gas supplies to that country totaled 10.4 bcm or 5.6% of Europe’s total. Moreover, the super-fast growth of gas supplies to China has nothing to do with Gazprom’s efforts to find new consumers: Gas supplies through the Power of Siberia pipeline began in late 2019, and by 2025 they should reach their design capacity of 38 billion cubic meters per year.

Whiskey disappears

One of the components of the U.S. sanctions against Russia was a total ban on the export of alcoholic beverages. Although the European Union did not adhere to this decision, prohibiting shipments of drinks priced over €300 per bottle, all global companies selling spirits—Pernod Ricard, Diageo, Bacardi, and others—have suspended sales or announced their withdrawal from Russia. As a result, in the first half of the year, the importation of solid drinks into the country decreased by almost 35%. Imports of whiskey (48.4%), vodka (41.7%), and liqueurs (36.6%) fell the hardest.

Gazprom, which owns 50 percent plus one share of the company, bought its stake in 2007 for less than half its real value after the Kremlin threatened to shut down the project because of alleged environmental violations.

I switched to moonshine, whiskey is imperialist shit!