August 4, 2022

15 years isn’t enough

Expel the dollar at any cost

Individuals prefer gold

Don’t want to fight? You won’t get a job

Has the bottom rung been reached?

We will go the other way

Non-traditional support

Thoughts and facts

15 years isn’t enough

On April 11, Russian politician Vladimir Kara-Murza was detained for 15 days; on April 22, he was summoned for interrogation and charged with spreading fake news about the Russian armed forces. On the same day, he was arrested by court order for the duration of the investigation. The criminal case against the politician was one of the first of its kind in Russia (at least 80 similar cases currently are pending) and had an essential element: The investigation accused Kara-Murza of actions committed outside Russia. According to the investigation, the politician “spread knowingly false information about the bombing of residential areas, social infrastructure, and the use of other prohibited means and methods of warfare by the Russian armed forces in Ukraine” while addressing the lower house of the Arizona Legislature on March 15, 2022.

The penalty under the fake news article is up to 15 years in prison. But that was not enough for Russian authorities, and a new criminal case was opened this week against Kara-Murza, this time accusing him of collaborating with an undesirable organization. He is accused of participating in “the organization and holding of a conference in support of political prisoners” on October 27, 2021, which was timed to coincide with the Day of Remembrance of Victims of Political Repressions (October 30). The investigation claims that the conference costs were paid by the American organization Free Russia Foundation, recognized in Russia as undesirable.

This is the first criminal case under the “undesirability” article instituted for cooperation with the Free Russia Foundation. Previously, all claims under this article were filed against members of Open Russia.

Vladimir Kara-Murza began his political activities at 18 and, for many years, worked closely with Boris Nemtsov, who was murdered in Moscow in February 2015. Vladimir played a crucial role in expanding the scope of the Magnitsky Act in the U.S.—at his urging, a provision was included in the final text of the bill that included violations of the rights to freedom “of expression, association, and assembly, as well as the right to a fair trial and democratic elections” as actions that fall under the law.

In May 2015 and February 2017, he was hospitalized twice in Moscow with similar poisoning symptoms.

Expel the dollar at any cost

The Bank of Russia is determined to remove dollars, euros, and currencies of other “unfriendly countries” from the Russian financial system. These ideas are contained in a document published for public discussion on the development of the Russian financial market under sanctions.

The Bank of Russia stated that there are significant risks associated with the possibility of new sanctions and the loss of banks’ assets placed in unfriendly currencies. In addition, the regulator believes that the imposed sanctions create significant obstacles to making payments in unfriendly currencies, increasing the risks for banks and the economy.

To force banks to get rid of unfriendly currencies, the Bank of Russia intends to set higher risk ratios for foreign currency loans and securities for assets denominated in unfriendly currencies. Thus, the Bank of Russia wants to set higher reservation levels for deposits in unfriendly currencies to reduce the share of foreign exchange on both sides of banks’ balance sheets, assets, and liabilities (that is called deforeignization).

The regulator hopes that Russian banks will move forward with new restrictions or disincentives for customers who want to keep their savings in currencies of “unfriendly countries.” Today, many Russian banks set high fees for payments in dollars and euros (and some banks refuse this service to clients altogether) and negative rates on deposits, reaching 1% per month.

The Bank of Russia knows that banks are intermediaries and provide customer services. Therefore, there is a hint in the document’s text that restrictions on the use of unfriendly currencies may also be imposed on the companies. As for the state companies, the Bank of Russia strongly recommends the government make a directive decision, forcing the companies to transfer their settlements into other currencies.

“It would be advisable for non-financial organizations to transfer their accumulated currency funds in currencies of unfriendly countries to other currencies. Concerning companies with state participation, it would be justified for the Russian government to issue relevant directives (recommendations).”

The Bank of Russia’s declaration of abandoning the use of currencies of “unfriendly countries” is somewhat strange to me because of the need to reduce risks for banks and their clients. The “unfriendly currencies” category includes all freely convertible currencies used for international transactions. In addition, financial instruments denominated in these currencies are the most spacious and stable. Transfer of assets into other currencies will lead to a sharp increase in financial risks for banks and complicate asset management.

But we should remember that the actions of the Bank of Russia after February 24 are political, and we should not look for financial logic in them.

Individuals prefer gold

Russian individual investors agree with the latter thesis—faced with restrictions on the use of foreign currency savings, they started to buy physical gold actively. This process acquired a large scale after the VAT collection was abolished in March when gold was sold to physical persons.

According to a Kommersant survey, Sberbank customers bought 10.9 tons of gold bullion in five months. In mid-April, VTB reported the sale of 2 tons of gold bullion to customers, but the bank did not disclose more recent data. Promsvyazbank, over the past four months, has sold 1 ton of gold bullion.

Banks have noted that the demand is for bars of all sizes—from 1 g to 12.5 kg (400 ounces). A significant proportion of the gold bars accounted for large bars of 1 kg (VTB sold bars of even 100 kilograms). But as Sberbank reported, “Demand for large bars of 1 kilogram and above is gradually calming, and demand for bars of smaller denominations remains high.”

Obviously, gold is seen by Russians as a very-long-term savings instrument: Given the volatility of the world price of gold, such investments can bring profits in 10 years or more.

Don’t want to fight? You won’t get a job

The online publication Wyorstka (Page-proofs) estimated that at least 1,793 Russian servicemen refused to participate in the war in Ukraine. Information about 1,550 soldiers was found in the media; in addition, one of the refuseniks told the publication that there was a special detention center in the city of Bryanka, Luhansk Region, where at least 234 Russian servicemen were forcibly detained.

According to Russian law, a contracted serviceman has the right to terminate his contract in connection with a “substantial breach of contract,” which includes his assignment to participate in combat operations outside the country. In practice, however, exercising this right is becoming increasingly complex: The command equates such demands to betrayal, isolates those who refuse and applies psychological pressure on them.1 Some servicemen who refused to participate in the war were stamped with the inscription “Prone to treason, deceit, and falsehood,” which became an obstacle to finding a civilian job.

Has the bottom rung been reached?

The Russian authorities have cheerfully reported that the worst time for the passenger car market is over: After production dropped 33 times in May, the situation improved in June—the drop was only 11 times. Moreover, they claim that from June to July, sales of new cars grew slowly after the catastrophic fall in May (minus 83.5% by May 2021). However, the experts claim that half of the sales growth is concentrated in the segment of super-cheap cars produced by state-owned AvtoVAZ. The increase in demand is related to the launch of the program of subsidizing car loans initiated by the Ministry of Industry.

We will go the other way

“Soviets have

their proper dignity—

to the bourgeois

we do not condescend”

—As written by Vladimir Mayakovsky in August 1925

In November 2021, at President Biden’s initiative, the U.S. Congress passed the Infrastructure Investment and Jobs Act, which provided $1.2 trillion over eight years. This money would be invested in roads, airports, electric transportation, broadband, water, and other infrastructure segments. Although enacted, there is no definitive list of targets for investment; it will emerge, be amended, and change throughout the law’s implementation by means of routine political bargaining between Washington and the states, between the President and members of Congress, and among members of Congress.

The Russian authorities decided not to borrow from this barbaric practice. They chose to do something more straightforward: The Ministry of Finance included in the 2022-2025 budget 1 trillion rubles, which would be used for the construction of the National Energy Strategy of the Russian Federation—that is 1 trillion rubles to be provided to the regions in the form of infrastructure loans (for a term of 15 years at 3% per annum).

This program was born during the coronavirus recession and was designed to support regional economic growth. In April 2021, speaking in his annual address, President Putin announced the allocation of 500 billion rubles to the regions to finance investment projects in the years 2022-2023. A fundamental innovation of Putin’s budget policy was that the regions were given the right to choose the projects they wanted to implement on their own. Of course, they did not get a free hand: All their applications would be sent to the federal government to decide which ones to support. The total volume of applications in 2021 amounted to 1.3 trillion rubles, which led to the expansion of the lending program.

Forty percent of the funds will be used for the development of transport infrastructure, 30% for the modernization and expansion of municipal infrastructure, and 20% for road construction.

Non-traditional support

The Russian government has decided to help Yandex, VK, and Ozon to fulfill their obligations to the holders of their Eurobonds.2 After the suspension of trading in the shares of these companies on foreign stock exchanges following the invasion of Ukraine by the Russian army, bondholders had the right to demand early redemption of all issues. No such demands have been made so far, but the companies need about $2.4bn in their accounts to remain operational.

This is the first case of large-scale financial support by the Russian government for “new economy” companies, which indicates the recognition of their systemic importance. Yandex and VK play an essential role in the work of the Kremlin’s propaganda machine (the former restricts the distribution of news, excluding those that do not correspond to the Kremlin’s position; the latter is the operator of the largest Russian social networks and is preparing a potential replacement for the service) and their sustainability is vital to the Russian authorities. Meanwhile, Ozon, an online retailer, can hardly be of “selfish” interest to the Kremlin.

Previously, during the 2008-09 crisis and 2014-15, only state companies, banks, commodity exporters, and arms manufacturers could count on such large aid packages.

Thoughts and facts

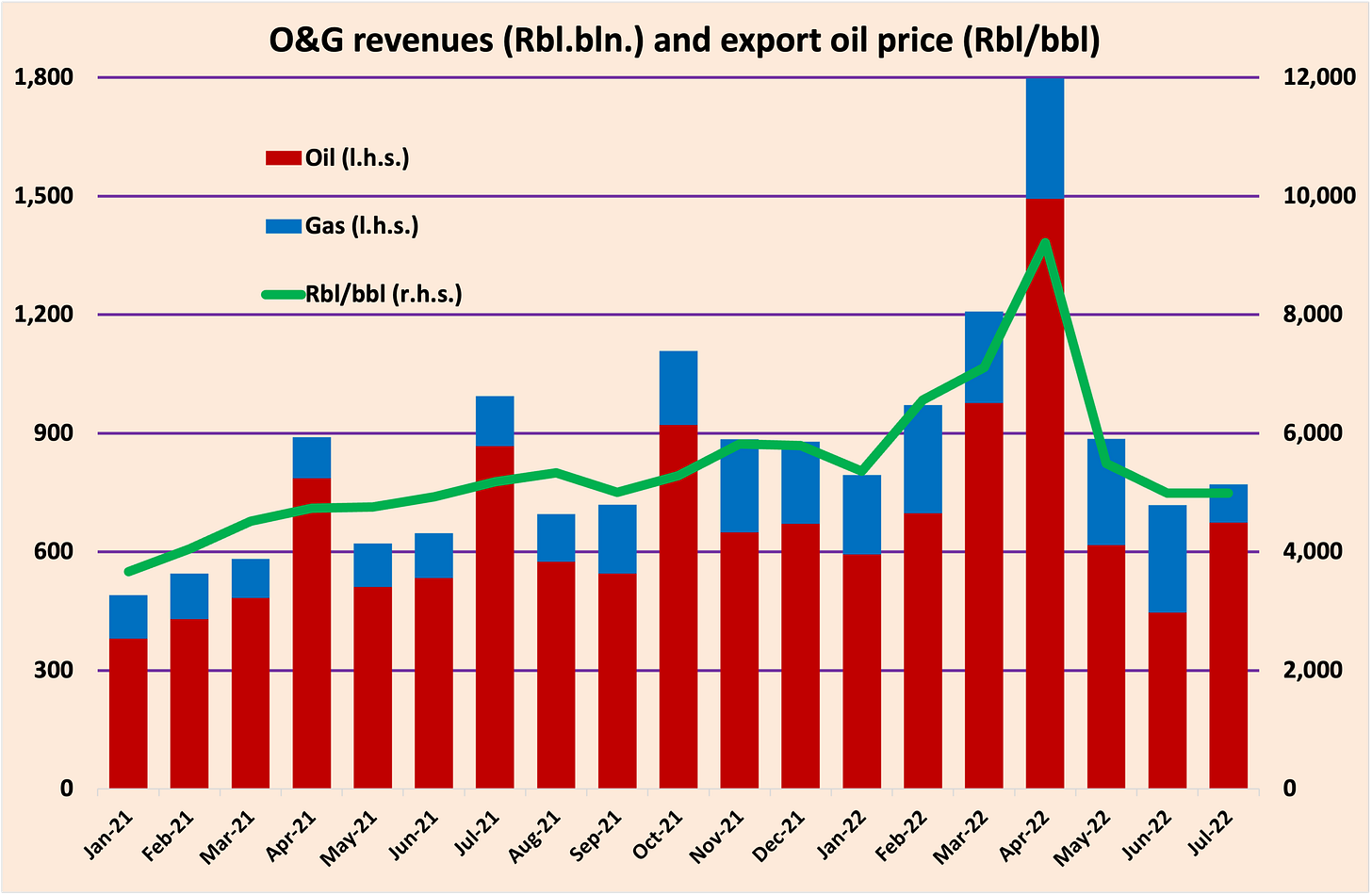

The Finance Ministry’s announcement of a drop in oil and gas revenues in July sparked a lively discussion in the media, many of which began to conclude (finally) about the sanctions pressure that had started to take its toll. However, such assessments are not supported by a minimal check of the facts, which suggests that July did not bring any surprises.

The oil and gas revenues of the federal budget are tied to hydrocarbon production and exports: In 2021-2022, 75%-80% were linked to oil; 75%-80% were tied to oil, gas condensate, and petroleum products, with the rest coming from gas. In the past 18 months, the share of revenues from gas has been increasing slightly, which was caused by the rapid growth of gas prices due to the reduction of gas exports by Gazprom.

Another critical factor explaining the dynamics of oil and gas revenues is the ruble-dollar exchange rate: Tax and duty rates are set in U.S. dollars.

In July, it became known that an improvised blackboard appeared in military unit 74814 in Budennovsk. On it, the leadership placed the names of 310 soldiers who refused to participate in military actions. The accompanying text says that they "refused to fulfill their military duty and left their combat positions at the place of permanent deployment," and thus "failed their comrades, dishonored their kin, their country, and their dignity.

VK reported sending a "request to the government for a preferential loan to restructure the debts the company had incurred." Yandex representatives said that the company received a loan from a commercial bank, and "the subsidization of interest rates was a part of an agreement between the bank and the government."