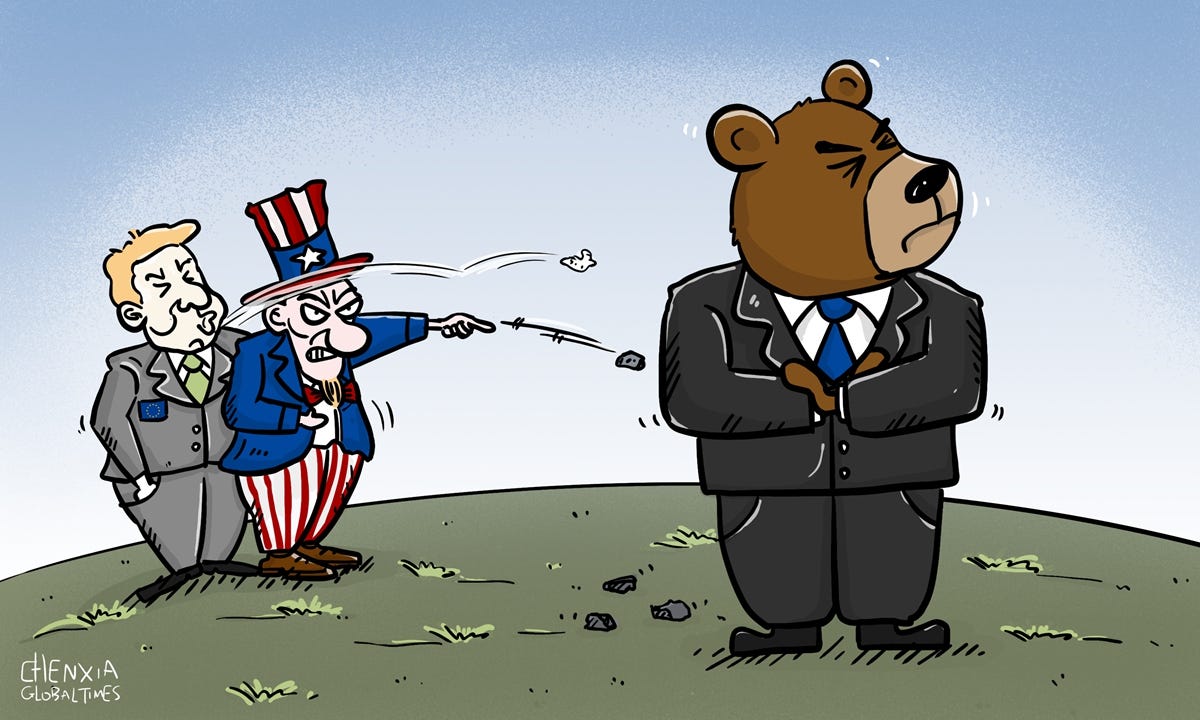

After the Russian army invaded Ukraine, unleashing a bloody war in the middle of Europe, not a week goes by without a politician or journalist asking me similar questions: when the Russian economy will collapse because of sanctions or, at the very least, when Vladimir Putin will run out of money to wage war. In addition, they ask at what point the Russian people will stop tolerating deteriorating living standards and revolt to force the Kremlin to change its policies.

While Western sanctions significantly hurt the Russian economy, the effect does not seem so devastating when looking at statistical data. The GDP decline was very modest; moreover, the Kremlin declared that the economy started recovering in the fall. Russian financial system withstood all sanctions, and, following the initial shock, the national currency stabilized and stay so during the year. The budget deficit exceeded expectations, but this was caused not by the revenue decline but by an extraordinary increase in expenditures in the last week of 2022. Though private consumption contracted by 7 percent compared to the previous year, no significant social (not saying political) unrest emerged, and public support for Vladimir Putin didn’t collapse.

Given all the above, I must first emphasize that sanctions cannot trigger political change. Otherwise, North Korea, Iran, and Cuba regimes would not have withstood 50 to 70 years under harsher sanctions than those imposed on Russia. Moreover, no economy can be shrinking forever, even under sanctions pressure. At a certain point, contraction ends, and the economy starts expanding. For example, Iran’s average growth rate from 1990, when the country’s GDP was 17 percent below the pre-revolutionary peak, to 2020 was 2.8 percent, which is approximately equivalent to the global economy’s dynamics.

Second, sanctions on Russia are actually working and working hard. The GDP growth in 2021 was 5.6 percent, and the outlook for 2022 was over 4 percent. But instead, last year, the Russian economy contracted by 2.1 percent despite being significantly boosted by military expenditures. Such a sharp shift from growth to recession has not been recorded in any country with a GDP of over $100 bn (5 percent of Russia’s GDP) since 2000 unless we consider contractions caused by the 2008 global financial crisis or the 2020 pandemic crisis. Moreover, previously, such a recession in Russia has always been caused by falling oil prices, but in 2022, the price of Russian oil (adjusting for all the discounts) was 10 percent higher than a year before.

Third, Russia’s economy turned out to be very robust because of its role as a supplier of natural resources to the global economy. The combined share of hydrocarbons, metals, wood, basic chemical goods, and grain exceeds 80 percent in Russian goods export. The country accounts for 17.5 percent of global oil sales, 47 percent of palladium, 17 percent of nickel, and nearly 25 percent of potash fertilizer sales, not to mention wheat, lumber, copper, etc. The world economy could perhaps give up Russian raw materials, but then it would have to brace itself for a dramatic price hike and a multi-year recession. The most significant contraction in Russian industrial production was in the automobile sector (a decline of 70 percent) and so-called white goods, or large electrical goods used domestically, such as refrigerators and washing machines (by 50 percent), which resulted not from the sanctions imposed by various governments, but by the “moral sanctions” stemming from the exodus of international companies from Russia. But the share of these sectors in the Russian economy is minuscule.

Fourth, the G-7 policy, aimed at limiting the Russian budget for the revenues from hydrocarbon exports while not removing Russian oil and gas from the market, finally took shape by February 2023, when the price ceilings for Russian oil products were set. Still, the intention to do so was clearly articulated in the spring of 2022, leading to Russian oil trading falling into a gray zone’s non-transparent pricing. Starting in April 2022, Russia’s Ministry of Finance set Russian oil production and export tax rates at a 25-percent discount to the Brent price, increasing the discount to 40 percent in recent months. According to my estimates, the Russian budget was short about $65 billion in revenues in 2022 (17 percent of its annual revenues).

Fifth, financial sanctions—freezing the accounts and assets of the central bank and commercial banks, restricting international payments and access to capital markets—usually have the most immediate economic impact. In the spring of 2022, inflation in Russia took just two weeks to accelerate to 10 percent per month and for the dollar to appreciate by 60 percent. That demonstrates how strong these sanctions were compared to those imposed in the summer of 2014 when the Malaysian MH-17 flight was shut down in Eastern Ukraine by a Russian-supplied Buk missile. Back then, it took six months for inflation to accelerate to 4.5 percent per month, and the national currency collapsed amid simultaneously falling oil prices.

In other words, recent sanctions are harsh, and they are working, and yet Russian authorities might have quite powerful instruments to continue counteracting financial sanctions. By the end of the first week of March, Russia’s Central bank implemented a set of actions to create an effective antidote—depriving the ruble of its free convertibility status by imposing restrictions on current and capital transactions. These measures ensured a strong positive current account that stabilized the exchange rate and suppressed inflation. Moreover, they nullified the effect of freezing the Central Bank’s assets—you don’t need them to have a strong current account and restricting capital control.

The real cost of these decisions will be enormous: non-paid dividends, coupons, interest, royalties, and capital gains amount to dozens of billion dollars per year, and Russia should make these payments one day, but neither the Kremlin nor the Central Bank care about it today. They will continue kicking the can down the road until it explodes. But then dealing with that can will be somebody else’s responsibility.

Sixth, though sanctions affected the economy, public opinion polls suggest that less than half of the Russian population is concerned with this issue. According to the Levada Center, about 20 percent express serious concern, and a similar number express moderate concern. At the same time, Russians find it difficult to specify what they are concerned with, pointing mainly to the rising prices and falling incomes (both of which have been cited as significant problems by Russians for over the past 30 years) as well as to the disappearance of familiar drugs from pharmacies. However, no country has imposed sanctions to prohibit the export of such drugs to Russia.

A significant part of the sanctions’ effect is long-term and delayed in time. The technological backwardness of the Russian economy will grow, but this process will be gradual, stretching for years, if not decades. Therefore, it should not be expected that, at some point, the quantity of sanctions will turn into quality, causing a quantum leap in public opinion.

Does the West have the potential to increase sanctions pressure on Russia in such a way that would make Russians realize that an aggressive war has consequences for everyone? Yes, absolutely, and this potential involves restricting the supply of consumer and food products or goods necessary for their production. For example, Russia imports about 90 percent of sourdough from the European Union to produce sour cream, 90 percent of potato and sugar beet seeds, over 80 percent of vegetable seeds grown in greenhouses, and 70 percent of sunflower seeds. The ban on their delivery to Russia will lead to a severe change in the situation in the Russian food market and will be noticeable to everyone. Still, for this to happen, Western politicians must give up the self-imposed narrative that sanctions should not affect ordinary citizens.

Last but not least. Although sanctions work, they have not and will not affect Mr. Putin’s determination to continue the war. On the one hand, the fiscal situation is deteriorating slowly, and Russia’s Ministry of Finance has tools to solve the emerging problems: the accumulated fiscal reserve of about 4.5 percent of GDP is twice the budget deficit planned for the current year, and the total public debt is less than 20 percent of GDP. In addition, one should not forget that the Russian budget pays for military expenditures in rubles, while revenues from hydrocarbon exports are tied to the dollar price of oil. Thus, a devaluation of the ruble will always create additional ruble revenues.

For Mr. Putin, the war in Ukraine is existential. His decisions are not based on carefully weighing the pros and cons. The war dealt Russia and its future a heavy blow. Still, it is not apparent that the Russian leader adequately understands the price the country will pay for his geopolitical adventure.

The sanctions have disrupted the rhythmic engine of Putin’s economy but have not stopped it or brought it to the brink of collapse. The economic problems facing Russia today do not look daunting to Vladimir Putin and do not force him to stop his aggression. Only military force can do that.

Good overview of sanctions -- but the effect of sanction-caused scarce micro-chip supply and the effect on “smart-missile” production wasn’t noted. It would seem this, at least from the Ukrainian perspective, would be an extremely important effect of sanctions.

Sanctions also provide “distraction” -- the country’s leadership needs to address other issues in the economy rather than devote their full attention to the war.

Sanctions neither win wars nor change regimes by themselves (as noted), they undermine the warring country’s ability to prosecute the war -- at least not as effectively as they could have without sanctions.

Support your point! Thank you! Surely, sanctions rarely reach their political goals immediately or in full. But even a parcial success (to gradually decrease fiscal revenues) is considered also a success. Expanding the import embargo on food and consumer goods is not a way, this would only consolidate people stronger around the flag. And let me additionally remark that sanctioned economies like, say, Iran can expand only nominally, under permanent downfalls and high inflation, they are gradually lagging behind the world average in terms of per capita GDP (according to the World Bank data in constant prices). So, sanctions are not an optimal tool but the only one (among peaceful means) to limit possible scales of aggressive behaviour.