I need your understanding

It probably would be hard to choose a more difficult time to launch a news digest. Events are occurring so quickly that they are out of date by the time they are published, and there is simply no time left to comprehend them. Moreover, the main current news is about military action, where each side is willing to provide only misinformation that I lack the skills to analyze. However, there are many experts who do this very well.

News from Russian society disappears from the spotlight because it does not help me answer the main question: When will Russia say, “No to war!” so loudly that the Kremlin cannot help but hear it?

The analysis of the economic news, which tells us how the Russian economy lived a month ago, loses all relevance because tomorrow, it will have to live in entirely different conditions, and no one can yet say in what situations.

In such a situation, I will switch to “mosaic mode”: I will provide information without commentary or with a very brief report. Of course, if something important happens that requires clarification/evaluation, I will do so.

If you have any ideas on what could be done in these circumstances, please let me know.

War

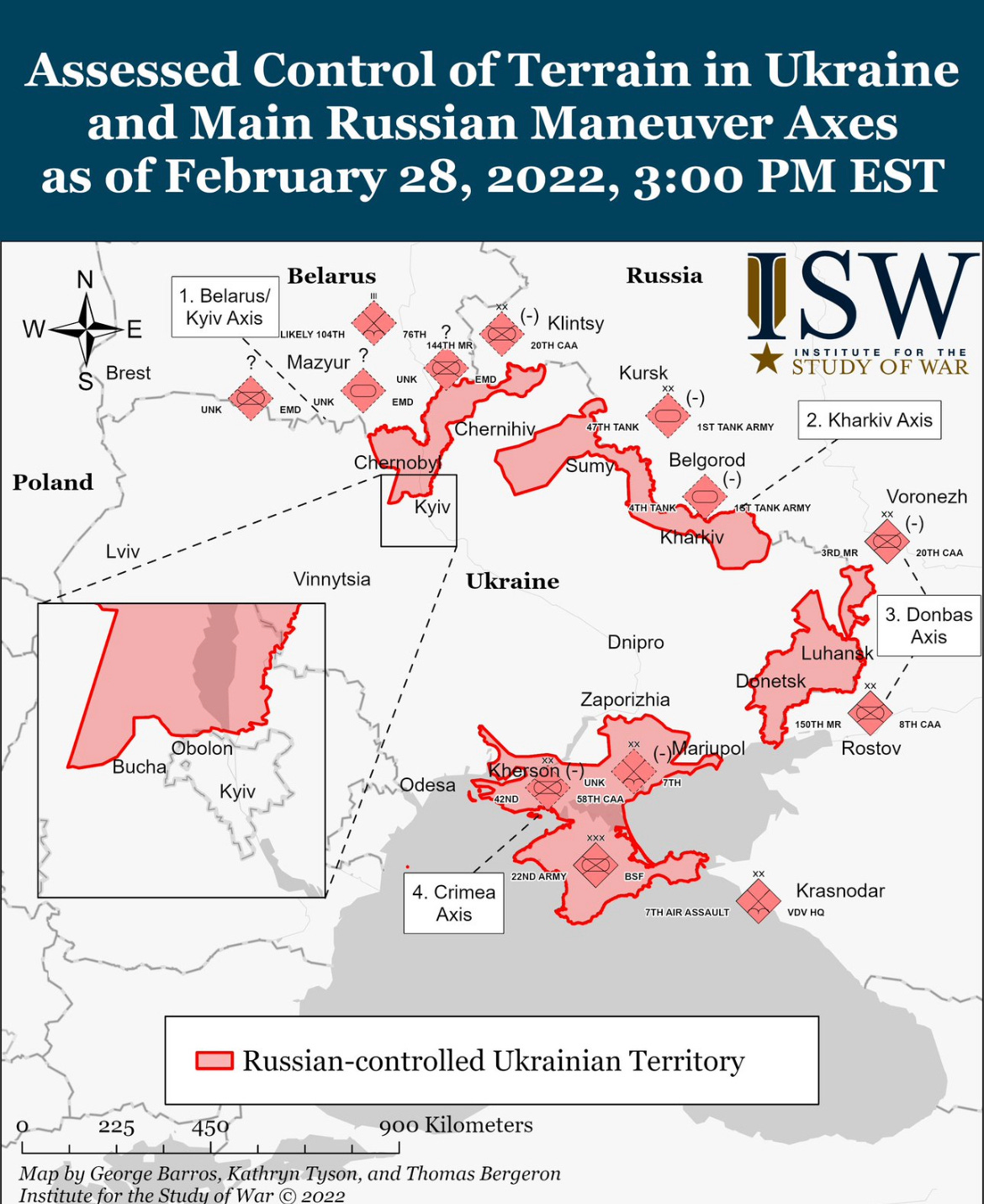

The Russian army continues offensives that fit less and less into a meaningful logic. It feels like it has no coherent strategic plan, or else the plan involved taking Kyiv and changing Ukraine’s political leadership within 24-48 hours. For the past three days, the main fighting has been near Kyiv and Kharkiv, and on the coast of the Sea of Azov. In Kyiv, Russia is relying on sabotage groups to infiltrate the city. In Kharkiv, the war has entered the city’s borders, and the Russian army has begun using multiple rocket launchers that are striking residential neighborhoods in the city. On the Azov Sea coast, Russian forces continue to “break through a corridor” from Crimea to LNR/DNR territories, which threatens to encircle a grouping of Ukrainian troops in Mariupol with unpredictable consequences: No one has yet found a way to capture significant cities without destroying them or slowly strangling them as food and ammunition supplies run out.

The Ukrainian army resists stubbornly, but Ukraine has few offensive weapons, constraining its ability to confront the aggressor. If NATO countries decide to supply Ukraine with offensive weapons (even limited-range ones), the Ukrainian army’s capabilities will increase manifold.

The war has caused a strong patriotic upsurge in Ukraine. President Vladimir Zelensky has shown himself to be a solid national leader capable of inspiring the nation; in many regions, the ordinary people have taken up arms and are opposing the Russian troops.

The first round of Russian-Ukrainian talks took place on Monday and lasted five hours in an attempt to find common ground for an early cease-fire and cessation of hostilities.

Ukrainian President Zelensky said, “So far, we do not have the result that we would like to get.” At the same time, he noted that the Russian side voiced its positions at the talks, while Ukraine put forward counterpoints “to end the war.” “Some signals [from the Russian side] we got,” Zelensky added.

The comment from the Russian side was the same.

This does not sound very optimistic, given that the bloodshed has not been stopped, and the next round of talks could take place “in the next few days.” Speaking at a Security Council meeting, the Russian representative to the UN said that Russia would be ready to end the war when “Kyiv is ready to demilitarize,”—i.e., capitulate.

I have even less reason for optimism after the Kremlin press service reported Vladimir Putin's phone conversation with President Macron and quoted the Russian leader

"A settlement is possible only with unconditional acceptance of Russia's legitimate security interests, including recognition of Russian sovereignty over Crimea, resolving the tasks of demilitarization and denazification of the Ukrainian state and ensuring its neutral status."

Fighting sanctions

The sanctions announced by Western countries against Russia proved to be strong. They forced the Russian authorities to take extraordinary measures capable (according to the Kremlin) of softening the first blow. The main direction of the decisions taken was to create a barrier to capital outflows and support the functioning of the domestic foreign exchange market.

On Sunday, the Bank of Russia decided to ban non-residents selling Russian companies’ stocks and bonds on Russian stock exchanges. Early Monday morning, a similar ban was imposed on residents, but in a different form—trading at the Moscow exchange was suspended until March 5.

On Monday, President Putin signed a decree requiring Russian companies to sell 80% of their foreign-currency earnings from exports. It was a retrospective provision and applied to revenues received in January and February. Russian authorities consider this norm effective, although it only works when the sales rate is at the market level. 1

Large fluctuations characterized currency trading on the Moscow Exchange: The dollar was 117 rubles at the opening (against 86 rubles at the closing of trading on Friday), and by the time of the morning fixing, when the Bank of Russia sets the official rate for the next day, it fell to 93.56 rubles, then increased to 105 rubles, and in the afternoon, it was between 95 and 100 rubles. The trading volume (with delivery tomorrow) during the day amounted to $25.8 billion, 2.5 times more than the maximum volume recorded during the past month. The Bank of Russia said it did not take part in the trading, but it appears to have prepared for such trading volume and reached agreements with major exporters and banks not hit by sanctions to support the market.

The Bank of Russia decided to raise its interest rate from 9.5% to 20% and provide unlimited ruble liquidity to banks, and significantly loosen prudential supervision for the near term.

Mosaic of the day

Since Thursday, police in Russia have detained 6,440 people for participating in anti-war rallies.

More than 1 million people have signed a petition “No to War!” on change.org.

The U.S. State Department recommended that Americans should immediately leave Russia.

Germany and Belgium advised their citizens to leave Russia.

The largest importers and distributors of alcohol in Russia—the companies Simple and Luding—have stopped shipments of products in retail networks in connection with the sharp rise in the euro. They previously called the exchange rate of 90 rubles per euro “critical” for their business.

CFM International, a joint venture between GE Aviation (a division of General Electric) and French Safran Aircraft Engines, one of the world’s leading aircraft engine manufacturers, has suspended engine shipments to Russia. Russian airlines use approximately 800 CFM56 engines, which power the Airbus A320 and Boeing 737. Saturn, the Russian company that makes the engines for Russian Superjets, may face problems in engine production, as they use components made by CFM.

Volvo to stop production and sales of cars in Russia.

Oleg Deripaska, whose fortune (until last week) was estimated by Forbes at $3.9 billion, criticized the Bank of Russia’s decisions in the wake of Western sanctions. “The rate hike, the mandatory sale of currency—this is the first test of who this banquet will be at whose expense. We very much want clarification and clear comments on the economic policy of the next three months. Now, as in 2014, it will not be possible to sit tight. It is necessary to change the economic policy; it is essential to end all this state capitalism.”

Deripaska has not voiced his proposals for changing economic policy, and his criticism of the actions of the Bank of Russia has not surprised anyone in the country for a long time—the oligarch has consistently advocated a policy of cheap credit and more active participation of the Bank of Russia in lending to the economy.

The German airline Lufthansa, “due to the current regulatory situation,” will not use Russian airspace until May 27. Earlier KLM and SWISS had claimed not to use Russian airspace.

The Prime Minister of Canada, Justin Trudeau, said that his country was refusing to import Russian oil. Canada announced plans to ban the import of Russian oil. However, the volume of such exports is highly insignificant and, most likely, is associated with the traders’ netting operations.

The UK’s BP said it had decided to give up its 19.5% stake in Rosneft on Sunday. If the company fails to find a buyer willing to buy those shares amid sanctions, it is ready to write them off and recognize a $25 billion loss. In addition, BP said it would withdraw from four smaller Russian projects valued at $1.4 billion.

On Monday, Shell said it intends to withdraw from joint ventures with Gazprom, including 27.5% of the Sakhalin-2 LNG project, 50% in Salym Petroleum Development, and Gydan Energy, as well as to stop participating in the Nord Stream 2 gas pipeline project. The company estimates investments in these projects at $3 billion, and it is prepared for this decision to “affect the carrying value of Shell’s assets in Russia and lead to their impairment.”

Netflix refused to comply with the requirement of Russian law to broadcast Russian television channels in its programming. In December 2021, Netflix was added by the Russian media regulator and censor Roskomnadzor to its register for audiovisual services because Netflix reached over 100,000 subscribers. Consequently, Netflix is required by the law to distribute 20 “must-carry” free-to-air Russian news, sports, and entertainment TV channels for users in Russia.

The decree also prohibits Russian residents from transferring foreign currency to their accounts in foreign banks, as well as transferring foreign currency to non-residents under loan agreements. Late Monday night, the Bank of Russia banned payments to non-residents of income on securities issued by Russian companies (coupons and dividends).